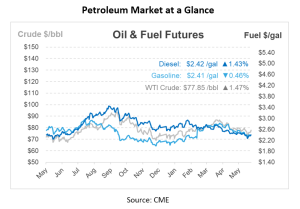

Brent Price Forecasts Range $75-90 as Diesel Prices Climb

During yesterday’s session, crude and diesel futures experienced some of the strongest increases of the second quarter, while gasoline saw modest advances. WTI and Brent increased by over $2, with July WTI rising to $77.74/bbl, and August Brent saw a $2.01 spike. This shift comes as analysts at Goldman Sachs maintain their forecast for Brent oil prices to range between $75 and $90 per barrel. The forecast reflects a mix of market dynamics.

Following drone attacks, it’s estimated that Russia’s refining capacity has dropped by 500,000 to 1 Mbpd, prompting interest in buying diesel for the latter half of the year. July ULSD increased by 6.3 cents, closing at $2.4147/gal with a slight contango heading into the fall season. Physical diesel prices climbed by 6.25 c/gal in most regions, with Chicago experiencing a particularly notable rise of over 9 c/gal.

Gasoline did not gain much despite higher crude prices. In the first week of June 2023, the Energy Information Administration (EIA) reported implied demand at 9.218 Mbpd. However, expectations for the upcoming Wednesday report are more modest. Initial surveys indicate that weekly demand trends are steady, making it challenging to surpass last week’s EIA measurement of 8.95 Mbpd. Significant pressure on gasoline demand comparisons is anticipated around the summer solstice. Between June 16-30 last year, demand averaged 9.426 Mbpd, indicating that nearly 198 million barrels of gasoline found a market domestically during that period.

The latest Brent price forecasts from sources like BMI and Rigzone average $85/bbl in 2024, $82/bbl in 2025, and $81/bbl in 2026 through 2028. Bloomberg predicts lower forecasts with prices in the $70/bbl range in 2026-2028. After a rally in the first quarter of the year, Brent crude prices have declined to $80/bbl as geopolitical risk premiums have subsided. Despite this, Goldman Sachs maintains a forecast range of $75 to $90/bbl for Brent oil prices.

Goldman sees $75 as a firm floor for Brent prices, citing several factors at play. First, physical demand for oil, including from China and the U.S. Strategic Petroleum Reserve (SPR), typically increases when prices fall. Second, increased financial demand if the currently low speculative positioning returns to normal levels. Third, U.S. oil supply remains price-dependent, and OPEC can adjust its production plans to stabilize the market. OPEC’s agreement on new production baselines through 2026 indicates stronger cohesion among its members, further reducing the likelihood of prices falling much below $75.

On the other hand, Goldman anticipates a $90/bbl ceiling for Brent, which assumes no significant geopolitical supply disruptions. OPEC has announced a data-dependent strategy to gradually unwind voluntary production cuts starting in the fourth quarter if the market tightens.

According to Goldman’s research, consumer spending and strong summer demand for transportation and cooling are anticipated to create a deficit of 1.3 Mbpd in the third quarter. As a result, they forecast Brent prices to increase to $86/bbl in Q3.

Their 2025 average Brent forecast remains at $82/bbl. This projection incorporates a modest downgrade in 2024 demand growth to 1.25 Mbpd, driven by China, and the decrease is balanced by a slight reduction of 0.1 Mbpd in 2024 non-OPEC supply.

This article is part of Daily Market News & Insights

Tagged: brent, diesel, fuel prices, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.