U.S. Refinery Activity Boosts Inventories Across the Board

In a continued effort to ramp up production, U.S. refiners significantly increased their operational capacity last week, leading to notable gains in crude oil, gasoline, and distillate inventories, according to a recent report from the Energy Information Administration (EIA). This surge in refinery activity has brought total stock levels closer to the five-year average, with gasoline and distillate inventories standing well above figures from the same periods last year and in 2022.

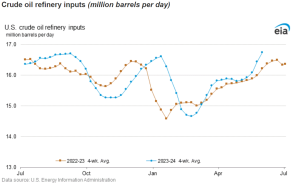

Operating at an impressive 95.4% capacity, refiners processed 17.584 million barrels per day (b/d) of crude oil and other feedstocks, marking the highest run rate since late 2019. Despite the high processing rates, gasoline production saw a slight decline to 9.686 million b/d, while distillate production inched up to 5.061 million b/d. Jet fuel production also increased, reaching 1.875 million b/d, the highest output level since the end of 2019.

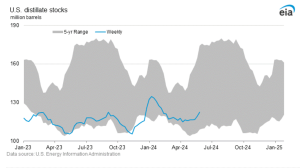

The EIA reported that gasoline inventories rose by 2.1 million barrels, and distillate stocks increased by approximately 3.2 million barrels. The East Coast (PADD 1) and West Coast (PADD 5) regions experienced significant gasoline stock builds, with increases of 1.9 million barrels and 900,000 barrels, respectively. Central Atlantic (PADD 1B) gasoline stocks entered June at a three-year high, potentially affecting gasoline futures.

Distillate inventories climbed for the third consecutive week, reaching 122.5 million barrels, the highest level since early February and almost 11% higher than last year. The only regional decline was in the Gulf Coast, where stocks fell by 700,000 barrels, likely due to a surge in distillate exports, which jumped by nearly 350,000 b/d to 1.38 million b/d.

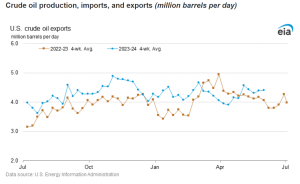

Despite the elevated refinery runs, U.S. crude oil inventories managed to grow by 1.2 million barrels to 455.9 million barrels. The U.S. exported over 4.5 million b/d of crude oil last week, with a four-week average nearing 4.4 million b/d, according to the EIA data.

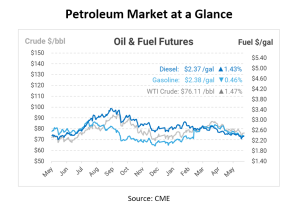

As refiners continue to boost operations, the resulting inventory increases are poised to impact market dynamics and pricing trends in the coming weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.