Week in Review – June 7, 2024

Prompt crude futures are up more than 30c/bbl this morning, retaining yesterday’s increases but remaining on pace to close the week down just over $1/bbl for the week. After moving through several technical stages, prompt crude prices concluded yesterday’s session up about $1.50/bbl, holding the gains made Wednesday and reversing more of the losses incurred earlier in the week. The WTI prompt spread for July 24 vs August 24 settled 6c/bbl higher on the day, and the WTI calendar spread for July 24 versus July 25 rose by more than 40c/bbl, perhaps reflecting the rise in oil prices.

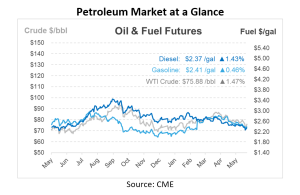

Since mid-April, retail gasoline prices have been declining. Wholesale prices have decreased by 10%–15% in most states and by 20%–23% in California. Of these reductions, less than 33% were carried through the pump. June is too premature to identify a catalyst for global diesel prices, but diesel prices are moving up in tandem with oil.

OPEC+ ministers reaffirmed their commitment to maintaining market stability and swiftly halting or reversing production changes if needed. They rejected the market’s reaction to the group’s agreement to gradually increase output in October. Crude oil benchmarks and refined product prices have seen their first significant rally since the OPEC+ meeting. Some ministers warned that the cartel was being judged too harshly, as supply and demand metrics look favorable for producers and refiners through August. However, problems could arise when demand surges shift to more pedestrian consumption in September through November.

US Energy Secretary Jennifer Granholm has suggested that the US could accelerate the replenishment of the Strategic Petroleum Reserve as maintenance is completed by the end of the year. Granholm believes the global oil market is well-supplied and expects no significant price increase in the near future. The US has been buying 3 million barrels of oil per month for the Strategic Petroleum Reserve since 2022.

The latest U.S. nonfarm payrolls data for May could reveal the timing of Federal Reserve interest rate cuts this year. Lower rates boost economic growth and oil demand. Goldman Sachs predicts a 160k nonfarm payroll increase in May, lower than the consensus of +185k. Tight labor markets often slow job growth during the spring hiring season, especially in May.

Prices in Review

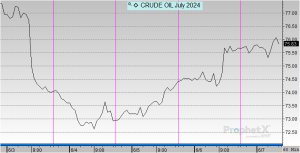

Crude opened on Monday at $76.97, dropped slightly on Tuesday and Wednesday and climbed back up beginning on Thursday. This morning, crude opened at $75.67 a decline of $1.30 or -1.689%.

Diesel opened the week at $2.3872, and traded similar to crude with losses on Tuesday and Wednesday and then bouncing back up on Thursday. This morning, diesel opened at $2.3607, a drop of 2 cents or -1.11%.

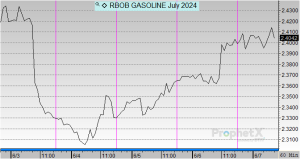

Gasoline opened the week at $2.4201, and followed the same trajectory as crude and diesel. This morning, gasoline opened at $2.4032, a drop of almost 2 cents or -0.69%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.