Oil Prices Drop Over $1 Amid OPEC+ Supply Decision

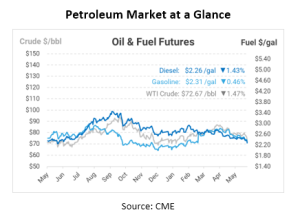

Oil prices fell on Tuesday, dropping over $1 due to growing skepticism about OPEC+’s decision to boost supply later this year despite signs of weakening global demand. Brent crude futures declined by $1.13, or 1.4%, to $77.23 a barrel, continuing the decline from a four-month low observed on Monday when prices fell below $80 for the first time since February. U.S. West Texas Intermediate (WTI) crude also dropped, easing $1.21, or 1.6%, to $73.01 a barrel.

Sunday’s OPEC+ meeting saw the group extend all three layers of production cuts through the third quarter of 2024, maintaining a 3.66 million barrels per day (mmbpd) reduction through 2025. However, they will allow eight members to gradually unwind their voluntary cuts starting in October, heightening concerns about oversupply, especially as traders worry that high interest rates might dampen global economic activity. Persistent signals from major economies like the US, China, and Europe indicate that their demand for oil may not be as robust as anticipated for the remainder of the year.

Analysts at GIR suggested this decision introduces downside risks to their Brent price forecast of $75-90 per barrel, given the group’s strong inclination to resume production. “The market reaction is discouraging for producers but beneficial for consumers,” commented Tamas Varga of oil broker PVM.

Adding to the supply concerns, non-OPEC producers are ramping up their output. IG market strategist Yeap Jun Rong warned, “With a prevailing ‘bad news is bad news’ sentiment, further economic weakness could drive oil prices even lower, potentially testing the $72 range.”

The US is set to release crucial inventory and product-supplied data on Wednesday. This data will shed light on gasoline consumption during the Memorial Day weekend, marking the start of the driving season. Carsten Fritsch, an analyst at Commerzbank, emphasized the importance of oil demand trends in the upcoming quarters.

Last Friday, prompt crude prices ended the week up by over 70 cents per barrel after rising more than $2 per barrel earlier due to escalating geopolitical tensions in the Middle East. The July 2024 versus August 2024 WTI prompt spread closed the week down by 23 cents per barrel at +26 cents per barrel, just ahead of the OPEC+ meeting.

US crude exports from the Gulf Coast increased 25% in May, reaching 1.916 million barrels per day, largely driven by higher shipments to Asia. In contrast, exports to Europe dropped by 5% due to refinery maintenance. Meanwhile, Canadian oil exports declined with the start of the Trans Mountain Pipeline, offering an alternative export route from Vancouver.

As the market continues to process these developments, the focus will remain on economic indicators and OPEC+ policy changes to forecast future oil price movements.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.