Market Challenges Weigh on Crude Oil Prices

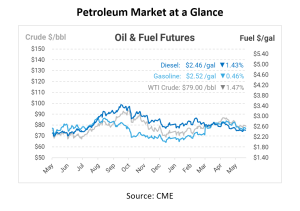

Crude oil futures have continued their downward trajectory, with prices falling by over $1.30 per barrel this morning. This decline extends yesterday’s losses and coincides with the expiration of the June 2024 WTI futures contract. This scenario has cast a shadow over market optimism, contributing to the bearish trend in crude prices. This morning, spot premiums for Middle East crude benchmarks also fell. Notably, the Brent premium to Dubai reached its lowest level since December as most refiners have completed their purchases for July-loading cargoes. This development reflects a weakening demand in the physical markets, intensified by a lack of fresh geopolitical news that could have otherwise supported prices.

Yesterday, prompt crude prices closed the day down by over 25 cents per barrel, trading within a relatively narrow range. For instance, the Louisiana Light Sweet crude grade fell to a three-week low of +$2.33 per barrel over WTI. This decline was influenced by a stronger U.S. dollar, which rose after Federal Reserve officials indicated they were waiting for more evidence of declining inflation before considering interest rate cuts. Additionally, prompt crude volatility reached its lowest levels since 2019, marking a period of relative market stability despite ongoing economic uncertainties. Meanwhile, Russian President Vladimir Putin reported a 1.8% year-on-year decline in the country’s oil output to 195.7 million tons, attributed to voluntary production cuts in cooperation with OPEC+.

In Russia, the 240,000 barrels per day Tuapse refinery resumed operations on Sunday following a drone attack last Friday. This event highlights the ongoing risks to oil infrastructure in conflict zones, which can influence supply dynamics. Last week, Brent crude prices saw a slight increase, supported by softer-than-expected US CPI data and a further decline in U.S. crude inventories. Despite geopolitical tensions, including the deaths of Iran’s president and foreign minister and increasing drone attacks on Russian oil infrastructure, oil prices remained rangebound. Market participants are now awaiting OPEC’s decision in early June, with Brent’s second-month rolling volatility reaching a five-year low.

Global physical crude markets have been softening due to reduced refinery demand and robust supply levels. The price of North Sea Forties crude fell to a discount of 97 cents per barrel to dated Brent, the widest differential since January 2023. Similarly, WTI Midland cargoes in Northwest Europe were priced 69 cents per barrel below the dated Brent contract, the lowest since last May. In the US, physical crude markets also showed signs of weakening, with lower-than-average refinery processing rates contributing to the trend. In a bid to manage domestic supply, Russia temporarily lifted its ban on gasoline exports. Refiners are now permitted to export gasoline from May 20 to June 30, as per a government decree signed by Prime Minister Mikhail Mishustin. This move aims to prevent overstocking at refineries while ensuring domestic supplies are met.

The International Energy Agency (IEA) recently revised down its forecast for non-OPEC ex-Russia supply growth in 2024 by 0.2 million barrels per day to 1.1 million barrels per day. This revision aligns closely with GIR’s forecast of 1.2 million barrels per day. The IEA’s assessment considers upside risks from Canadian and Chinese supplies, supporting their call for a $90 per barrel ceiling on Brent. Meanwhile, gasoline exports from China fell to their lowest level since 2015 last month as refiners awaited new shipment quotas. Exports dropped to 400,000 tons in April, down 65% from March levels, equivalent to about 111,000 barrels per day. Diesel shipments also decreased by 46% month-over-month to 760,000 tons, the lowest since February. This decline is attributed to reduced refining activity during China’s peak maintenance season, which shortened fuel output.

The crude oil market is experiencing volatility influenced by various economic, geopolitical, and supply-demand factors. As analysts await OPEC’s upcoming decision, the market remains on edge, with prices reflecting the complex interplay of global events and economic indicators.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.