Week in Review – May 10, 2024

This week’s crude oil market experienced some volatility, primarily driven by geopolitical tensions and adjustments in the supply chain. Crude oil futures rose by 57 cents per barrel this morning. This movement sets the market on track for a weekly gain of over $2 per barrel. The rise in prices follows recent geopolitical events, including drone attacks on Russian crude refining facilities reported by Bloomberg as the second Ukrainian strike in two days.

Yesterday’s trading session continued the bullish trend, with prompt crude prices closing up by more than 25 cents per barrel, building on gains from Wednesday. These were spurred by a U.S. Energy Information Administration report, which revealed a larger-than-expected increase in U.S. crude inventories of 1.4 million barrels, significantly above the 0.5 million barrels anticipated by the American Petroleum Institute. Additionally, the June 2024 versus July 2024 WTI prompt spread widened by 11 cents to settle at 46 cents, reflecting tightening balance expectations in the U.S. market.

On the global stage, Chinese refiners are reducing their intake of Saudi crude following a price increase by Saudi Aramco. This adjustment is expected to decrease exports to China by 5.8 million barrels in June compared to May. Concurrently, Canadian oil sands output is anticipated to grow significantly by about 500,000 barrels per day by 2030. This growth is supported by the expanded capacity of the Trans Mountain pipeline, which now allows an additional 590,000 barrels per day to be shipped to the Pacific Coast for export, thereby bolstering the industry’s growth potential.

In the United States, the Gulf Coast has seen a surge in imports from Saudi Arabia as refiners attempt to offset a shortfall of barrels from Mexico. Estimates suggest that imports from Saudi Arabia will average 395,000 barrels per day this month, doubling April’s figures and reaching the highest level since July 2020.

In Europe, Euroilstock data shows that European refiners’ crude and fuel stocks stood at 1.014 billion barrels in April, indicating a slight month-on-month decrease primarily driven by lower middle distillate stocks. Despite a modest monthly rise in crude inventories, the year-on-year comparison reveals a decline, signaling a tighter market than last year.

As for market pricing, Brent crude remained robust, trading above $84 a barrel, buoyed by strong demand indicators from the U.S. and China, the world’s largest crude consumers. Additionally, persistent conflicts in the Middle East have further supported prices, introducing a risk premium into the market due to ongoing geopolitical risks.

Numbers in Review

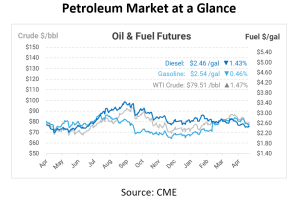

This week, crude oil prices exhibited modest fluctuations, starting at $78.81 on Monday and concluding slightly higher at $79.70 on Friday. The prices dipped midweek, reaching their lowest point on Wednesday at $77.91, reflecting a minor decline from Monday’s opening price. The most significant daily change occurred between Wednesday and Thursday, where prices rebounded from $77.91 to $79.51, marking an increase of $1.60. By the end of the week, the prices settled slightly higher than they started, showing an overall increase of $0.89, or approximately 1.13%.

Starting the week at $2.4409 on Monday, there was a slight increase to $2.4509 on Tuesday. The upward trend continued into Wednesday, reaching $2.4581. On Thursday, prices peaked at $2.4858, marking the highest point of the week. However, there was a slight retreat on Friday, with prices settling at $2.4680. The most notable change was observed between Wednesday and Thursday, indicating a considerable increase. This morning, diesel opened at $2.4680 on Friday, an increase of $0.0271 or 1.11%.

Gasoline opened on Monday at $2.5727, and it slightly decreased on Tuesday to $2.5624, marking a modest drop. Prices rebounded on Thursday to $2.5507 before slightly decreasing again on Friday to $2.5438, marking a decrease of $0.0289 or 1.12% over the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.