Natural Gas News – May 7, 2024

Natural Gas News – May 7, 2024

Texas Heat Wave Spurs Sharp Turn in Prices

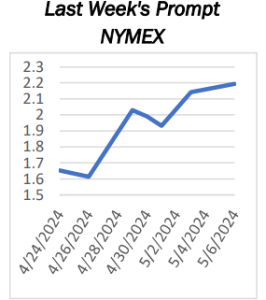

U.S. natural gas futures saw a sharp increase on Monday, buoyed by a shift to an upward trend as indicated by intermediate and short-term trend indicators. The market’s momentum has turned positive with futures trading higher after breaking significant trend lines. At 13:31 GMT, Natural Gas Futures are trading $2.214, up $0.072 or

+3.36%. According to NatGasWeather, current forecasts predict hot temperatures across Texas and the South, which are expected to drive demand between Tuesday and Thursday. However, a bearish outlook persists for areas east of the Rockies over the next 5 to 15 days. These mixed weather conditions influence both spot prices and futures, reflecting a volatile demand environment. Over the weekend, Texas’ high temperatures, alongside reports of increased feedgas usage by Freeport LNG exceeding… For more info go to https://tinyurl.com/2s4tzpnd

Natural Gas Prices Maintain Uptrend in Fourth Straight Day

Natural Gas (XNG/USD) retreated from its peak performance on Monday at $2.40 after markets were pricing in more risk premium on the heated-up situation in the Middle East. Although ceasefire talks are taking place again in Cairo, headlines on Monday showed that a deal is still far from near and Israel has started its ground offensive in Gaza’s southern city of Rafah. Meanwhile, Australian Liquified Natural Gas (LNG) exports are expected to drop

substantially with Chevron’s Gorgon plant remaining offline for at least five weeks. The US Dollar Index (DXY) is heading higher on Tuesday after Monday saw US Dollar bulls salvage it from a further slide by eking out a daily close above 105.00. That level is a line in the sand on the DXY chart in terms of more upside or downside. Natural Gas is … For more info go to https://tinyurl.com/3dw7n666

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.