Oil Market Responds to FOMC Anticipation and Middle East Diplomacy

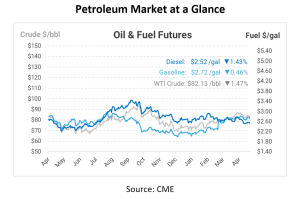

The oil market has seen a mixed bag of trends recently, with prompt crude futures increasing by 30 cents per barrel this morning despite a decline of about 35 cents in the overnight session. This change is part of a partial recovery from yesterday’s more significant loss of over $1.20 per barrel. These fluctuations occur as traders anticipate the outcomes of the May FOMC (Federal Open Market Committee) meeting, with US equity futures showing no significant changes and the dollar gaining strength.

In the geopolitical arena, prompt crude prices were previously deflated due to a de-escalation of tensions following US Secretary of State Antony Blinken’s diplomatic efforts between Israel and Hamas. Meanwhile, Russia’s crude oil flows have decreased for the second consecutive week. However, overall shipments remain above this year’s average, highlighting the challenges G7 insurers face in enforcing the price cap on Russian oil barrels.

The GIR weekly oil tracker suggests a decline in the Brent crude price to $84 per barrel by December 2024, despite the current price testing a $90 ceiling. This expectation accounts for a moderation in valuation, which slightly outweighs the anticipated decline in Q3 inventory levels. However, GIR also recognizes the potential benefits of holding long oil positions as a hedge against geopolitical shocks and for the advantages of roll returns.

In Mexico, the state-run refining company has seen its throughput increase to its highest in nearly eight years. This uptick is part of outgoing President Andres Manuel Lopez Obrador’s initiative to reduce dependency on expensive fuel imports. Although operational capacity reached 65.3% in March, recent fires at two refineries could potentially lead to reduced throughput in the upcoming months.

Globally, oil price forecasts for 2024 have been adjusted upwards, with Brent now expected to average $84.62 per barrel and West Texas Intermediate (WTI) projected at $80.46 per barrel. This revision reflects a stronger-than-anticipated market demand and continued production cuts by OPEC+. Despite these bullish indicators, the consensus among experts suggests that reaching a $100 per barrel price point remains unlikely due to the ongoing uncertainties and supply volatility linked to the Middle East conflicts.

The next OPEC+ meeting in June is highly anticipated, as decisions made regarding production adjustments for Q3-2024 will significantly impact the market. Analysts expect the consortium to aim to maintain production levels that support oil prices at $85 per barrel or higher, reflecting a strategic approach to managing the market’s supply-demand balance.

In the US, the situation is somewhat different, with traders rushing to secure storage capacity for distillate fuels along the East Coast due to an oversupply, compounded by lower-than-expected demand following a warmer winter. This has led to significant declines in refining margins and has shifted market dynamics, influencing futures pricing and storage strategies.

Moreover, in the Middle East, trading activities have intensified, with record volumes of crude traded on the Platts window in April, highlighting the region’s pivotal role in global oil markets. This is contrasted against the backdrop of potential adjustments in Saudi Arabia’s official selling prices, which might increase due to the strengthening of Middle East benchmarks.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.