Week in Review – April 26, 2024

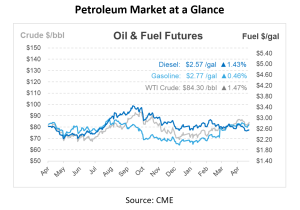

This week’s fluctuations in petroleum futures prices are casting uncertainty on whether this year’s peak prices for Brent crude oil and gasoline will be reached or surpassed. Oil prices are on the rise this morning by over 70 c/bbl, positioning them to close the week with an approximate gain of $1/bbl. This follows yesterday’s increase, where prompt crude prices climbed by 76 c/bbl, offsetting a previous decline of over 80 c/bbl.

The NYMEX RBOB contract’s rise from winter to spring started on the same date as the previous year, suggesting a potential repeat of last year’s April price decline. Despite the EIA reporting on Wednesday a drop in U.S. gasoline demand to its lowest mid-April level since 2014, at 8.42 Mbpd, both gasoline and crude experienced buying interest on Thursday.

Meanwhile, the NYMEX June WTI contract saw a moderate increase, climbing 76 cents to close at $83/bbl. Similarly, June Brent crude also rose, gaining 99 cents to end at $89/bbl. Trading volumes on both NYMEX and ICE were subdued, and the focus has shifted from geopolitical tensions to economic concerns.

US Treasury Secretary Janet Yellen has suggested that GDP growth could be adjusted upward. She also predicted a decline in inflation following several unusual economic pressures that contributed to the weakest economic performance in nearly two years. The U.S. dollar has weakened after preliminary data revealed a 1.6% annualized GDP growth in the first quarter. This morning, equity futures are on the rise, and the U.S. dollar is relatively stable as the market anticipates today’s PCE report, with Goldman Sachs forecasting a 0.3% increase in Core PCE.

Recently, a downturn in Asia diesel margins has led several refiners in the region to decrease their operations, potentially affecting crude oil imports. Profits from converting Dubai crude into diesel in Asia have dropped over $5/bbl since the beginning of the month, standing 26% lower than the five-year seasonal norm. A prominent Asian refiner has already reduced its operations this month, and another is contemplating a cutback in July. The expected reductions in production are anticipated to be modest, varying between 20 to 40 thousand bpd.

Prices in Review

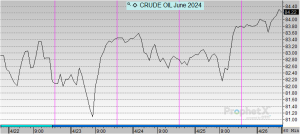

Crude opened the week at $83.05 and saw minor up and down swings throughout the week. This morning, crude opened at$83.81, an increase of 73 cents or 0.915%.

Diesel opened on Monday at $2.5369 before seeing two days of minor increases. On Thursday it began to taper off again. This morning, diesel opened at $2.5588, an increase of 2 cents or 0.863%.

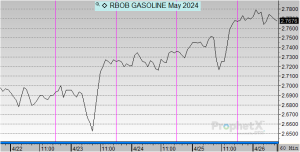

Gasoline opened the week at $$2.7089, saw a minor drop on Tuesday, and then traded up the rest of the week. This morning, gasoline opened at $2.7699, an increase of 6 cents or 2.25%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.