Supply Concerns Wane Following Muted Iran-Israel Conflict, Lowering Prices

Oil prices fell for a second consecutive day on Tuesday, influenced by alleviated fears about supply disruptions following a muted attack by Iran on Israel over the weekend. On Friday, concerns that Iran would retaliate for the attack on its embassy compound in Damascus had driven Brent crude prices over $92/bbl, marking the highest level since October. The anticipated impact of the conflict on supply chains diminished after the initial assessments of the attack suggested minimal damage, leading to a drop in oil prices on Monday.

Also contributing to the decline in oil prices is the release of stronger-than-expected U.S. retail sales data for March. This strong economic indicator reinforced the likelihood that the U.S. Federal Reserve will not hasten to cut interest rates, a situation that could dampen oil demand.

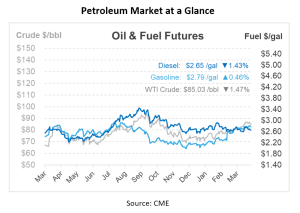

On Monday, crude oil benchmarks fell by more than $1/bbl for most of the day. Prompt crude futures were trading lower by approximately 50 c/bbl after having risen by about 75 c/bbl in the overnight session. Ahead of a scheduled discussion featuring Fed Chair Jerome Powell and Tiff Macklem, Governor of the Bank of Canada, U.S. equity futures and the dollar remained unchanged. Yesterday, WTI and Brent crude both closed nearly unchanged, following a drop of over $1.50/bbl earlier in the session.

A large refiner in India has put WTI Midland crude for resale to other buyers across Asia for the May loading schedule. This decision likely came from a boost in the acquisition of Russia’s Sokol crude, leading to a shift away from the more costly US crude. In Russia, the volume of crude shipped overseas has reached the highest level seen in nearly a year. For the past week, Russia’s seaborne crude shipments reached 3.95 Mbpd, the highest rate since May 2023. The average over the past four weeks has also reached its highest point since June 2023, well above the export targets set by OPEC+. At the same time, Russian refining activities are near their lowest in 11 months, primarily due to repairs necessitated by Ukrainian drone attacks. Previously, a backlog of Russia’s Sokol crude had built up due to rejection by Indian refiners, but this has now been fully resolved.

In China, oil processing volumes in March hit 63.78 million tons, the highest in five months, reflecting a 1.3% increase from the previous year. The uptick is mainly due to heightened demand following the Lunar New Year, coupled with refiners amassing fuel supplies in preparation for maintenance scheduled from April to June.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.