Week in Review – April 12, 2024

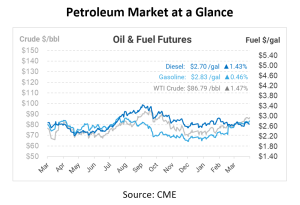

Oil prices surged by over $1 per barrel today, propelled by escalating tensions in the Middle East, particularly between Iran and Israel. Brent experienced a notable uptick, reaching $90.84 per barrel, while U.S. West Texas Intermediate crude futures rose by $1.10 to $86.79 per barrel. Despite these gains, both benchmarks are poised for a marginal weekly loss, reflecting market uncertainty.

The recent surge in oil prices can be attributed to concerns over potential supply disruptions stemming from heightened tensions in the Middle East. These concerns were further aggravated by an attack on Iran’s embassy in Damascus, allegedly carried out by Israeli warplanes, leading to fears of retaliation from Iran.

However, the market saw a brief price dip after the International Energy Agency (IEA) revised its forecast for 2024 world oil demand growth downwards to 1.2 million barrels per day (bpd). This adjustment came as a result of lower-than-expected consumption in OECD countries and a slump in factory activity, according to the IEA’s monthly oil report.

Despite the IEA’s revised forecast, OPEC’s outlook remains optimistic, with the group predicting a 2.25 million bpd growth in demand for crude oil this year. This disparity between forecasts has left the market somewhat divided, with some analysts leaning towards OPEC’s more bullish projection.

Analysts at ING suggested that oil prices may retreat unless there is a further escalation in Middle East tensions or significant supply disruptions occur. They maintained their forecast for Brent to average $87 a barrel over the second quarter of the year.

Friday’s gains managed to erase losses from the previous session, which were driven by concerns over stubborn U.S. inflation, dampening hopes for an interest rate cut in the near future. Federal Reserve officials signaled that there was no rush to implement rate cuts as inflation persisted.

Meanwhile, attention has turned to the United States as a critical player in the oil market. Recent data suggests a sharp decline in U.S. oil production in January, coinciding with a notable rally in oil prices, which have surged nearly 20% since the beginning of the year.

Oil analysts speculate on the future trajectory of U.S. oil production, highlighting the country’s pivotal role as the world’s marginal supplier. While acknowledging temporary factors behind the Q1 weakness, the analysts underscore potential downside risks to supply forecasts. This narrative emphasizes OPEC’s influence in balancing the market, with geopolitical considerations looming as a significant variable affecting oil price dynamics.

Analysts remain divided on the trajectory of oil prices in the coming months. While some anticipate a potential retreat in prices unless there is a further escalation in Middle East tensions or supply disruptions, others maintain a bullish outlook, citing factors such as strong gasoline demand, low inventories, and geopolitical uncertainties. Amidst these mixed signals, industry players are closely monitoring developments in the Middle East and economic indicators for cues on oil price direction.

Numbers in Review

On Monday, crude opened the week at $86.28. Tuesday witnessed a slight decrease to $86.22, followed by a more substantial drop to $85.34 on Wednesday. This morning, crude opened at $86.79, an increase of $0.51, or approximately 0.59%.

Diesel opened at $2.7290 on Monday, experiencing a slight decrease to $2.7180 on Tuesday. However, Thursday marked the most significant drop, with prices falling to $2.6717. The trend reversed on Friday as prices rose to $2.7027, although not fully recovering from earlier losses. On Friday, diesel opened at $2.7027, indicating an overall decrease of $0.0283 or 1.04%.

Gasoline started at $2.7652 on Monday and dipped slightly to $2.7628 on Tuesday. On Thursday, gasoline saw a reversal, with prices climbing back to $2.7717. On Friday, prices surged to $2.8255. This morning, gasoline opened at $2.8255, representing a $0.0603 or 2.18% increase in prices over the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.