Challenges & Opportunities for Oil Markets in 2024

2024 marks an important moment for the global oil and mobility sectors as they navigate through challenges and opportunities. According to S&P Global Commodity Insights, from geopolitical tensions to technological advancements, the landscape is surrounded by complexities that promise to reshape the trajectory of the industry.

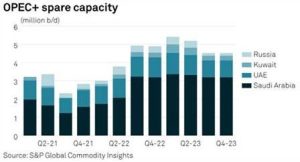

At the heart of the matter lies the intricate dance of supply and demand. OPEC+ is busy with debates on whether to continue limiting oil supply in pursuit of higher prices or to defend its market share. With spare production capacity at historic highs, the alliance faces a critical juncture in projecting its course amidst geopolitical tensions and shifting energy paradigms. This spare capacity, nearing 5 million barrels per day, is predominantly concentrated in Saudi Arabia and the UAE, adding complexity to the decision-making process.

Meanwhile, North America’s oil production continues to grow, driven by technological innovation and vast reserves of shale. In 2023, the US and Canada collectively produced over 41 million barrels of oil per day, marking a significant contribution to global supply.

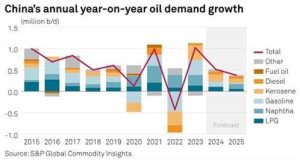

China’s demand for oil undergoes a period of transformation, with a growing emphasis on clean energy and sustainability. China’s oil demand growth is projected to halve from 1.02 million barrels per day in 2023 to just 490,000 barrels per day in 2024, reflecting shifting economic priorities and a greater focus on alternative fuels.

But it’s not just oil that’s undergoing a shift. Led by China’s push towards electrification, EV adoption is gaining momentum around the world. By November 2023, battery electric vehicles and plug-in hybrid electric vehicles accounted for a record 38% of new light vehicle registrations in China, signaling a shift in consumer preferences. Despite the rapid growth of EVs, affordability remains a major hurdle, particularly in markets outside of China where prices remain unaffordable for many consumers.

Global Oil Demand and Production Forecasts

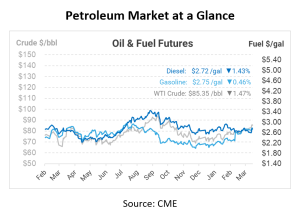

According to S&P Global Commodity Insights, global oil demand is forecasted to grow by 1.5 million barrels per day in 2024. The US and Eurozone play pivotal roles in these trends, while Asia, particularly China, India, and Southeast Asia, remains critical support, contributing 60% to the rise in oil demand. Additionally, oil prices, with Brent forecasted to average $83 per barrel, play an important role in shaping demand, with jet fuel, diesel, and gasoline acting as demand drivers.

Latin America’s oil production is expected to reach or surpass 9 million barrels per day in 2024, a milestone not witnessed since 2016. This resurgence is fueled by significant offshore developments in Brazil and Guyana, moving away from the traditional crude sources of Mexico and Venezuela. Brazil’s deepwater pre-salt fields have achieved record outputs, with more floating production, storage, and offloading (FPSO) projects in the pipeline. Similarly, Guyana’s Payara project, initiated in late 2023, is anticipated to contribute 600,000 barrels per day by 2024. The strategic geographical positions of Brazil and Guyana enhance their roles as key suppliers to major markets like China, the US, and Europe.

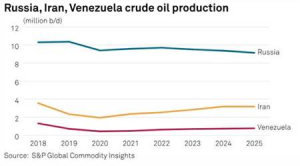

Stability in oil production from sanctioned suppliers like Russia, Iran, and Venezuela is also anticipated. Russia is expected to extend its supply cuts in collaboration with Saudi Arabia, highlighting the crucial role of their partnership in maintaining OPEC+ cohesion and price stability. However, while Iran may experience a temporary boost in output due to relaxed US enforcement, escalating Middle Eastern tensions could impede further production increases. Venezuela, despite eased sanctions, grapples with investment shortages, constraining its production potential to 800,000 barrels per day.

US Elections

The upcoming US elections in November present a culmination of broader uncertainties surrounding the country’s role on the global stage. The outcome could have deep implications for international relations, trade policies, and environmental commitments, thereby influencing the strategic calculus of oil markets and mobility sectors worldwide.

Therefore, adaptability, anticipation, and collaboration will be key in charting a course through the complexities that lie ahead, as the industry work to shape a sustainable and resilient future.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.