Oil Prices Calm Amid Baltimore Bridge Collapse

Global oil markets are relatively smooth this morning, with crude prices trading flat following recent rallies driven by geopolitical tensions and production cuts. This calm comes despite major upheaval in supply chain markets this morning: the Francis Scott Key Bridge in Baltimore, MD, collapsed after a collision with a cargo ship.

The Bridge, a crucial transportation link spanning outer Baltimore Harbor, collapsed following a collision with a cargo ship, raising concerns about regional supply chains. Emergency responders rushed to the scene, reporting that around 20 individuals had fallen into the Patapsco River during the incident. US Homeland Security Secretary Alejandro Mayorkas swiftly addressed concerns, stating there were “no indications” that the collision was intentional. Tracking data revealed the vessel involved was a Singapore-flagged cargo ship, with its owners confirming the collision.

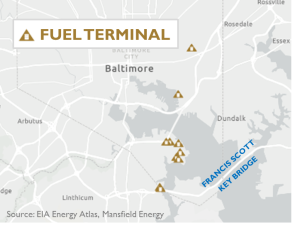

The impact on fuel supply is minimal, since Baltimore gets most of its fuel from pipelines rather than barge imports. However, Mansfield projects delays for fuel deliveries, which will last several months, since fuel trucks must now drive farther to deliver their loads. Longer routing means fewer deliveries can be made per day per truck, tightening local freight capacity. The gap could also impact local demand since the port is an essential hub for automotive shipments and for various commodities such as coal, sugar, and gypsum. As investigations into the Baltimore bridge collapse continue, authorities are working to restore normalcy to the region’s transportation networks while ensuring the safety of maritime traffic. Mansfield’s thoughts are with those harmed by the bridge collapse.

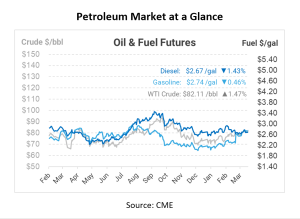

The incident comes amidst some calm in global oil markets. Crude prices traded flat today after recent rallies fueled by geopolitical tensions and production cuts. Front-month Brent crude futures, due to expire on Thursday, were up 11 cents to $86.86 a barrel at 1200 GMT, while U.S. West Texas Intermediate (WTI) crude futures edged up 19 cents to $82.14.

Russian refinery disruptions due to Ukrainian drone strikes have added complexity to market dynamics, with analysts closely monitoring supply chains for any further disruptions. Goldman Sachs analysts estimate the attacks have knocked about 900,000 barrels per day (bpd) of capacity offline, possibly for weeks and, in some cases, permanently.

Despite these challenges, US equity futures climbed slightly this morning, buoyed by expectations surrounding key economic reports scheduled for release today. February’s Durable and Capital goods data, coupled with Consumer Confidence reports, are anticipated to provide insights into the health of the US economy amidst evolving global uncertainties.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.