Week in Review – March 22, 2024

In a lively trading session on Thursday, petroleum futures made a notable recovery from early steep declines, closing the day with only slight losses. This shift in momentum is attributed to investors refocusing on prevailing supply concerns after an initial phase of profit-taking.

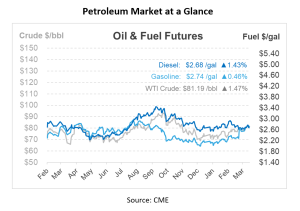

Optimism in the broader economy buoyed the U.S. stock market to close at new all-time highs, bolstering investor sentiment in the energy sector. Specifically, May contracts for NYMEX WTI crude experienced a minor decrease of 20 cents, settling at $81.70/bbl, despite facing losses exceeding $1 earlier in the day. Similar trends were observed in June WTI and ICE Brent futures, with modest declines across the board.

In the refined products market, diesel futures lagged behind gasoline for the second consecutive day, with significant attention on the May NYMEX ULSD contract, which saw a decline of over 2 cents to $2.6516 per gallon. Gasoline futures also edged lower, reflecting a cautious market response.

The U.S. dollar strengthened, rising by 0.6% following the Federal Reserve’s decision to maintain its federal funds rate, which in turn influences economic activity and currency valuations.

Amidst these financial movements, geopolitical tensions and strategic decisions are poised to support petroleum futures. The ongoing conflict involving Ukrainian drone attacks on Russian refineries has sparked speculations about potential Russian measures to manage its fuel supply, possibly affecting global oil dynamics.

Recent reports highlighted concerns over attacks on energy infrastructure, with significant implications for global oil supply and pricing. Additionally, developments in India refusing Russian crude due to sanctions and the operational adjustments at the Exxon Mobil Gravenchon refinery in France following a fire emphasize the complex interplay of geopolitical, regulatory, and operational factors shaping the oil market.

Alaska’s oil production and the strategic capacity of the Trans-Alaska Pipeline System also remain in focus, with expectations of increased output contributing to the overall market dynamics. Governor Mike Dunleavy of Alaska announced on Thursday that the state is currently channeling approximately 495,000 bpd of oil through the Trans-Alaska Pipeline System. He anticipates this figure will increase by 200,000 to 300,000 bpd as Alaska’s oil production expands. The pipeline, which achieved its highest flow rate of around 2.1 million barrels on January 14, 1988, stretches from Prudhoe Bay to the Valdez Marine Terminal.

Prices In Review

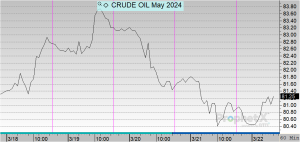

Crude oil opened on Monday at $81.03 and saw marginal gains on Tuesday and Wednesday before dropping back off on Thursday. This morning, crude opened at $80.84, a decrease of 19 cents or -0.234%.

Diesel opened the week at $2.7267, rose slightly in Tuesday’s session and teetered back off the rest of the week. This morning, diesel opened at $2.6630, a decrease of 6 cents or -2.336%.

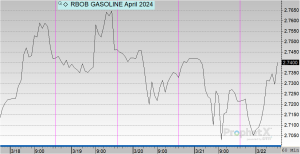

Gasoline opened on Monday at $2.7106 and saw slight gains during Tuesday and Wednesday sessions before tapering back off on Thursday. This morning, gasoline opened at $2.7201 an increase of one cent or 0.35%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.