Oil Markets See-Saw as Gasoline Creeps Higher Ahead of Driving Season

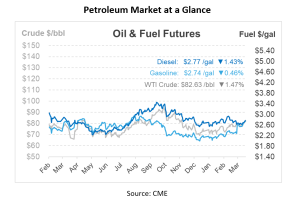

On Monday, futures for crude oil and refined products saw upward momentum, with contracts for NYMEX WTI and RBOB reaching new peaks for 2024. Although diesel futures also saw increases, they did not surpass the peak levels attained in February. Today, crude oil has shown a slight decline, influenced by the overall market dynamics, as the US dollar strengthens, and equity futures see a downturn. This morning, May contracts for Brent crude dropped to $86.74/bbl, and WTI decreased by 9 cents to $82.07/bbl. Set to expire on Wednesday, the April WTI contract also fell by 9 cents to $82.63/bbl. Factors such as the ongoing reduction in U.S. inventory levels, an optimistic outlook for the oil market from the International Energy Agency (IEA), and the impact of Ukrainian drone attacks on Russia’s Rosneft Ryazan oil processing plant have pushed Brent crude prices over the $85 per barrel mark.

The spread between the April 2024 and May 2024 WTI contracts widened by 10 cents per barrel to 56 cents, indicating expectations of a tighter US oil balance. Iraq announced its plans to cut oil exports to 3.3 Mbpd in the upcoming months to adjust for exceeding its OPEC quota of 4 Mbpd in January and February. Additionally, the EIA released its March Drilling Productivity Report, forecasting a modest increase in U.S. crude production by 10,000 bpd for April.

In related developments, prompt gasoline futures reached a six-month peak yesterday, driven by interruptions in Russian refinery operations and dwindling US fuel reserves, heightening supply anxieties as we approach the peak summer demand season. The rally in gasoline prices, which started on December 13 following a drop in prompt futures to slightly below $1.97 per gallon, has seen a sharp increase. By Monday’s close, the price for the April RBOB contract had jumped to $2.7573 per gallon, marking a near 79-cent increase. While this increase falls short of the pre-season surge experienced last year and other seasonal highs, gasoline prices have generally remained below 2023 levels throughout the year. However, the EIA anticipates that nominal gasoline prices from May to July will surpass the figures recorded during the same months in 2023.

Thousands of industry leaders are gathered at CERAWeek in Houston this week where it has been forecasted there will be an uptick in crude demand. A speaker at the event noted that drone strikes have incapacitated approximately 600,000 bpd of Russia’s refining capabilities, with some estimates suggesting the impact could be as high as 850,000 bpd. This damage is expected to curtail Russia’s diesel exports significantly.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.