Week in Review – March 15, 2024

This morning, prompt crude futures have dipped by 70 c/bbl, partially undoing yesterday’s increases. U.S. equity futures and the dollar have remained steady ahead of forthcoming economic data on manufacturing, industrial sectors, and consumer sentiment. Following the International Energy Agency’s (IEA) revised prediction of a crude shortage in 2024 and the extension of OPEC+ production cut expectations through year-end, prompt crude saw an approximate $1.50/bbl increase yesterday. To date this week, both prompt WTI and Brent have climbed over $2.80/bbl, reaching near a four-month peak.

This week, drone attacks by Ukraine on Russian refineries have heightened worries about supply shortages, leading to an increase in both fuel and crude oil prices. Reports emerged yesterday of a drone assault on a petrochemical facility near Moscow, continuing the trend of attacks on Russian oil infrastructure. As a result, Russian diesel exports have decreased by roughly 0.25 Mbpd since January, likely influenced by the drone strikes, unusually high exports in January, and Moscow’s strategy to limit fuel shipments in alignment with OPEC+ production reductions.

The International Energy Agency (IEA) flipped its crude forecast for 2024 to a deficit, citing extended OPEC+ production cuts through the year’s end. This revision, alongside an upgraded global oil demand growth forecast—now at 1.3 Mbps for 2024, led by demand from the US and Asia, excluding China—paints a bullish picture for oil prices. Notably, the IEA’s forecast remains below OPEC’s, which anticipates demand growth of 2.25 Mbps, underscoring differing views on the pace of demand recovery and the transition to cleaner energy sources.

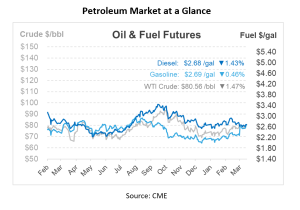

The U.S. is facing its own challenges, with gasoline prices surging ahead of the seasonal jump in demand. Major refinery outages have cut supplies, and national average prices for gasoline have risen sharply, exacerbated by declining fuel stockpiles and prolonged low refinery utilization rates. These factors, combined with heightened summer travel demand and global refinery issues, suggest gasoline prices could rise even further.

Since the beginning of the year, the national average cost for a gallon of gasoline has risen over 9%, reaching approximately $3.40 since March 8—marking the highest level since early November, as per AAA’s data. This jump in gasoline prices contributed to an increase in consumer prices last month, further complicating the persistent issue of inflation in the U.S. This development is expected to become a crucial topic of discussion as the presidential elections in November approach.

Prices in Review

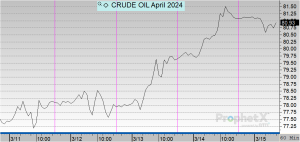

Crude oil saw a sizable increase this week, opening at $77.80 on Monday. Prices rose slightly on Tuesday, with not much movement on Wednesday, and then started its ascent on Thursday. This morning, crude oil opened at $81.14, a $3.34 increase or 4.29%.

Diesel opened the week at $2.63 before seeing slight increases on Tuesday and slight decreases on Wednesday. On Thursday, diesel started creeping back up and opened this morning at $2.747, an increase of 7 cents or 2.84%.

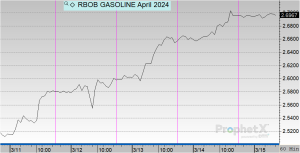

Gasoline saw increases throughout the week after opening on Monday at $2.5247. This morning, gasoline opened at $2.6969, an increase of 17 cents or 6.82%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.