What’s That Wednesday: Days of Supply

When making decisions on when to buy fuel, one important calculation to consider would be days of supply. The EIA (U.S. Energy Information Administration) calculation is a helpful metric in the energy industry, specifically for understanding the inventory level of crude oil, diesel, or other petroleum products. This calculation provides an estimate of the number of days that current inventory levels will last, given the current rate of consumption. It’s calculated by dividing the total inventory of a product by the product’s total consumption per day. Here’s the basic formula:

Days of Supply = Total Inventory (barrels or gallons) / Daily Consumption (barrels or gallons per day)

Understanding Days of Supply

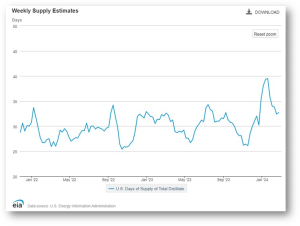

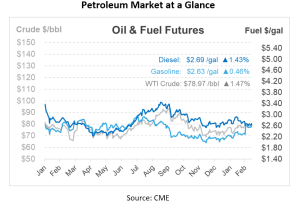

It serves as a key indicator of supply and demand dynamics in the fuel market. A lower days of supply figure might indicate tighter supply conditions, potentially leading to higher prices, while a higher number might suggest oversupply conditions, which could lead to lower prices. For fuel-buying customers, including businesses that rely on fuel for their operations (transportation companies, airlines, etc.), the metric can be crucial for operational planning and budgeting.

Understanding whether the market is in a situation of surplus or shortage can help them make informed decisions about when to purchase fuel and how much to purchase, potentially saving costs or avoiding supply shortages. It can influence strategic buying decisions. For example, if the days of supply indicate an increasing trend (i.e., inventories are growing relative to consumption), buyers might delay purchases in anticipation of lower prices. Conversely, if it is decreasing, buyers might need to secure supplies before prices increase further.

This calculation is also a tool for risk management. By monitoring changes, companies can anticipate market volatility and adjust their purchasing strategies accordingly, either to mitigate risk or to capitalize on market opportunities. Buyers often use the metric to time their purchases strategically, hoping to buy more when prices are lower. A consistently low days of supply complicates this strategy, as it may force buyers to purchase at higher prices to avoid running out of fuel, rather than waiting for more favorable market conditions.

Standard Range

A days of supply range of around 30 days suggests that there is enough inventory to meet demand for about three to four weeks, providing a buffer against sudden disruptions in supply. This level of inventory supports market stability by allowing time for adjustments in production or imports to meet changes in demand.

When the days of supply for fuel drops below 30 days, it can raise concerns for fuel buyers for several reasons, particularly in the context of crude oil, gasoline, and other petroleum products. This threshold is often seen as a critical point beyond which the balance between supply and demand may start to tighten, potentially leading to various operational and economic challenges. A lower number indicates tighter supply conditions relative to demand. In such scenarios, any disruptions in supply, whether due to geopolitical tensions, natural disasters, or production cuts, can have an immediate and significant impact on prices. This volatility makes it difficult for fuel buyers to budget and plan their purchases effectively. With less inventory available to meet demand, the risk of actual fuel shortages increases.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.