Oil Treads a Fine Line Between Geopolitical Tensions and Demand Concerns

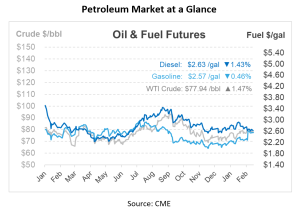

Prices are experiencing a modest increase this morning, driven by ongoing geopolitical tensions in the Middle East. Despite the rise, a sense of caution prevails among investors, stemming from concerns over future demand and the anticipation of crucial reports from leading oil agencies this week. May Brent futures witnessed a 0.6% increase this morning, reaching $82.69/bbl, while the April US crude contract reached $78.33/bbl, a 0.5% increase.

Despite several factors bolstering oil prices, concerns over demand and increased production from non-OPEC countries are applying downward pressure. The market is poised for a week filled with economic reports, including the monthly analysis from OPEC and the IEA, along with the release of U.S. inflation data for February. Additionally, a report by the EIA highlighted a record-breaking year for U.S. crude oil production in 2023, surpassing previous highs by 0.6 Mbpd.

The Middle East remains a hotbed of conflict, with the ongoing war between Israel and Hamas showing no signs of abating. The deadlock in ceasefire negotiations in Cairo and the continuing exchange of fire between Israel and Hezbollah raise the stakes in the region. Although the conflict in Gaza has not significantly disrupted oil supply lines, the Red Sea and the Gulf of Aden have become zones of concern with the Houthis’ attacks on maritime vessels since November, expressing solidarity with the Palestinians. The situation escalated further with reported airstrikes by a U.S.-British coalition in Yemen and the Houthis’ missile attack on a vessel they claimed was U.S. affiliated.

Recent events have also stirred the oil market, such as a temporary outage at a Texas refinery due to a leak, which is expected to be resolved soon. On the supply side, Russia has seen a notable increase in its crude shipments, reaching new highs for the year. Market analysts have been closely monitoring these developments, including the dynamics of gasoline and distillate cracks, which have experienced fluctuations following disruptions in the Red Sea.

In terms of trade, the re-export of Canadian heavy crude oil from the U.S. Gulf Coast saw a significant uptick in January, doubling figures from December 2023 and marking a four-month high. China remains the leading buyer, with India and Spain also contributing to the demand. The bulk of these re-exports originated from the Port Arthur district, underscoring its dominance in handling Canadian crude.

Looking ahead, the impending Trans Mountain Pipeline expansion is expected to shift the dynamics of crude oil exports. With the pipeline set to start filling in April, it’s anticipated that the volume of Canadian crude oil re-exported from the Gulf Coast could decrease in the latter half of 2024. This shift will likely see more crude being directed from Canada’s West Coast directly to markets on the U.S. West Coast and in Asia, altering the current trade patterns.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.