Week in Review – February 16, 2024

In the volatile world of crude oil trading, today’s morning session witnessed prompt crude futures experiencing a dip of 50 cents per barrel, diverging from the relatively flat trading observed overnight. This shift occurs against a backdrop of evolving market dynamics, punctuated by notable spreads and significant macroeconomic data releases.

A key highlight has been the rally in WTI spreads, notably evidenced by the March to April 2024 calendar spread trading in backwardation at 49 cents per barrel, marking its tightest position in over three months. This trend reflects market sentiments regarding near-term supply and demand dynamics, shedding light on traders’ outlook.

However, amidst these fluctuations, the broader economic landscape presents a nuanced picture. Recent data on US industrial production and retail sales for January fell below expectations, prompting Goldman Sachs Investment Research (GIR) to revise down their Q1 GDP forecast. Industrial production witnessed a marginal decrease of 0.1%, while manufacturing production experienced a steeper decline of 0.5%, both figures missing projections. GIR now anticipates Q1 GDP growth to be at 2.5%, down by 0.4 percentage points from previous estimates.

The retail sector also faced headwinds, with core retail sales slipping by 0.4% in January, exacerbated by a downward revision of December figures. Severe winter weather likely contributed to this decline, though the notable drop in e-commerce spending hints at deeper underlying factors at play.

Despite these economic concerns, crude oil rallied yesterday, climbing over $1.5 per barrel. This upward momentum persisted even in the face of the International Energy Agency’s (IEA) monthly report highlighting declining crude demand growth. Nonetheless, crude prices are expected to close the week relatively flat, maintaining a trading range of approximately $10 per barrel since December 2023.

Adding another layer of complexity to market dynamics is the Midwest refinery outage. Spot petroleum product prices at the Chicago trading hub are on the rise following an unplanned outage at bp’s refinery in Whiting, Indiana, on February 1. The 435,000-barrel-per-day (b/d) refinery, the largest in the Midwest (PADD 2), has been offline since then due to a power outage. Despite higher-than-average inventories of motor gasoline and distillate fuel in the Midwest, which could limit the outage’s effects on product availability and pricing, the situation adds uncertainty to regional supply dynamics.

In supply-side news, Bloomberg reported Russia’s near-full compliance with its pledged OPEC+ crude export cuts. With production slightly surpassing 9.46 million barrels per day (mmbpd) in January, Russia inches closer to its commitment of curbing 500 thousand barrels per day (kbpd) of production, pledged from February 2023. January’s production levels effectively represent a 490 kbpd cut from pre-commitment levels.

Furthermore, the US Department of Energy (DOE) announced the purchase of 2.95 million barrels of oil for the Strategic Petroleum Reserve at an average price of $77.81 per barrel. This strategic move adds to the significant volumes of oil procured since 2023, totaling 23.08 million barrels at an average price of $76.34 per barrel, alongside additional barrels acquired through exchanges with oil companies.

Prices in Review

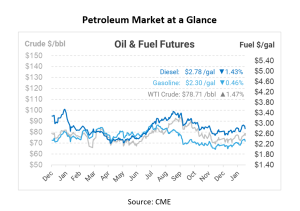

Starting at $76.74 on Monday, Crude price rose to $78.76 by Friday. The most significant changes occurred between Tuesday and Wednesday, with a jump from $77.26 to $78.54, indicating a gain of $1.28. However, Thursday saw a slight decline to $77.03 before rebounding on Friday. Overall, there was a gain of $2.02 or 2.63%.

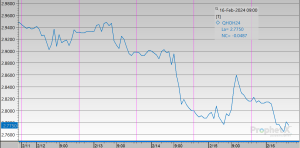

Diesel opened at 2.9277 on Monday and gradually decreased throughout the week. Thursday saw the most significant drop compared to the previous day, with a decrease of $0.0933. On Friday, diesel opened at $2.7769, representing a loss of $0.1508 or approximately 5.15%.

Over the week, gasoline prices fluctuated, experiencing both gains and losses. Starting the week at $2.3632 on Monday, prices rose slightly to $2.3748 on Tuesday and continued to increase to $2.3905 by Wednesday. However, the trend reversed on Thursday as prices dropped to $2.3192, followed by a further decrease to $2.2933 by Friday. Overall, gasoline prices experienced a loss of $0.0699, or approximately 2.96%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.