From Red Sea Tension to Refinery Outages, What Is in Store for Oil Prices?

Over the past few weeks, the global oil market embarked on a roller-coaster ride influenced by a complex interplay of geopolitical tensions, economic factors, and technical trends. These multifaceted dynamics left market observers closely monitoring the landscape of the oil industry.

Geopolitical tensions keep taking center stage as attacks on cargo ships in the Red Sea, attributed to the Houthis, disrupted oil flows through the Bab-El-Mandeb Strait, causing a significant decrease of 3 million barrels per day since December 18. Iran-aligned Houthis firing missiles at ships further escalated concerns about oil supply disruptions in the region. Earlier this morning, Reuters reported that another cargo ship sustained minor damages due to an attack while sailing in the Red Sea, marking the latest incident with the Houthis in the shipping channel.

Domestically, the United States grappled with refinery outages. While some units of an Oklahoma refinery were brought back online after technical issues, an unplanned refinery outage persisted. A 435 kbpd refinery in Indiana remained offline for the fourth consecutive day due to power loss, with no expected recovery timeline. These outages impacted the supply of refined products, adding pressure to the oil market.

On a global scale, Russia’s seaborne crude shipments rebounded from two weeks of disruptions, with record flows from the country’s main export terminals. Weekly average shipments rose by about 880 kbpd to the highest level this year, 400 kbpd above the level pledged to OPEC+ partners on a weekly basis. However, the levels are still 100 kbpd lower than the pledged output cut on a four-week average basis.

Hedge funds and portfolio investors also influenced oil prices last week. They raced to build bullish positions in petroleum futures and options contracts, purchasing the equivalent of 97 million barrels over seven days ending on January 30. This influx of investment capital added upward momentum to oil prices.

While short-term disruptions caused price spikes, economic factors such as soft China demand and an unseasonably warm winter weighed on oil prices. According to GIR’s China demand nowcast, it remained soft, down at 15.8mb/d, and an unseasonably warm winter was depressing global oil demand by just over 200kb/d. On the bullish side, GIR’s Russian liquids supply fell in the context of extra OPEC+ cuts and recent winter storms, and US crude supply year-over-year growth continued edging down following sharp increases, with the moderation driven by Permian production.

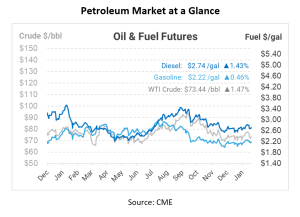

Future movements in oil prices are also being influenced by Federal Reserve rate decisions, as well as developments in RINs prices (Renewable Identification Numbers) and retail gasoline prices. RINs prices remained relatively cheap compared to other periods, with a price of 8.15cts on Friday.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.