What is that Wednesday – Shale Oil

Shale oil, a unique type of unconventional oil, has increasingly become a topic of discussion in regard to energy resources. To understand what it is, how it compares and differs from crude oil, its common use cases, where it can be found in the US, and how its price compares to crude oil, today’s What Is That Wednesday will walk through all of that and more.

What is it?

Shale oil refers to unconventional oil that is trapped within shale formations. It’s a fine-grained sedimentary rock composed of mud, clay, and organic matter. The oil within these rocks is not in liquid form; rather, it is solid or semi-solid, often mixed with sand, sediment, and water. In this case, extracting the oil is more complex than extracting conventional crude oil.

It emerged as a resource during World War II, as the United States sought a dependable energy source that could endure the challenges facing overseas supply lines. To meet this demand, the U.S. initiated a program in the 1960s to exploit its reserves commercially. However, the increased expense and complexity involved in extracting it rendered it a less efficient alternative to traditional oil wells. The industry saw a revival in the 1970s when the oil crisis temporarily made oil shale economically viable. Yet, this upswing was short-lived, as oil prices fell in the 1980s. In recent years, the interest in unconventional oil sources has fluctuated in line with the changing prices of crude oil.

Shale Oil vs Crude Oil

Both shale and conventional crude oil originate from organic materials. However, shale oil is found in shale formations where the organic matter has not reached the geological conditions (like temperature and pressure) necessary to convert it into liquid oil. In contrast, crude oil is formed when organic matter is subjected to higher temperatures and pressures, transforming it into liquid form.

The extraction of it involves hydraulic fracturing and horizontal drilling. This process entails injecting water, sand, and chemicals at high pressure to fracture the shale rock and release the oil. Conventional crude oil, meanwhile, is typically extracted through drilling wells that tap into underground reservoirs where oil is in liquid form. The extraction is often more controversial due to its environmental impacts. Fracking can lead to groundwater contamination, increased seismic activity, and higher greenhouse gas emissions compared to conventional oil drilling.

This type of oil typically has a different composition and quality compared to conventional crude oil. It might contain more contaminants like sulfur and needs extensive refining to be used.

How is it Used?

Shale oil is primarily used as a source of fuel and in the production of various petroleum products. Like conventional crude oil, shale can be processed into gasoline, diesel, marine fuel, and jet fuel. It can also be used in power plants and for residential heating. Refined shale oil is a key ingredient in the petrochemical industry for producing plastics, synthetic rubber, and other chemicals.

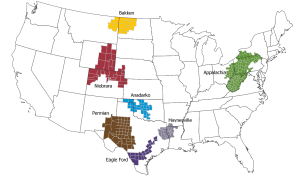

Reserves in the US

The United States has significant shale oil reserves, with major shale formations spread across the country. One of the largest and most prolific regions in the US is the Permian Basin in Texas and New Mexico. The Bakken Formation in North Dakota and Montana is another area known for its rich oil reserves. Lastly, the Eagle Ford Shale in Texas is another major source in the US.

Price Comparison

The pricing is relative to conventional crude oil can vary based on several factors, including extraction costs, market demand, and geopolitical influences. Generally, it tends to be more expensive to produce due to its complex extraction process. However, advancements in technology and increased efficiency in production have reduced costs over time.

In terms of market price, the value of shale oil can fluctuate in relation to global crude oil prices. It’s also influenced by domestic policies, transportation costs, and refining requirements. The break-even price production varies by region, depending on technological advancements and market conditions.

</p>

/>=”https://mansfield.energy/wp-content/uploads/2024/01/Screenshot-2024-01-24-095753-300×214.png” />alt=”” width=”486″ />ight=”347″ />

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.