Week in Review – January 5, 2024

Crude oil started the day on a high note, trading 90 cents per barrel higher, driven by escalating tensions in the Middle East due to the Israel-Hamas conflict. Simultaneously, equity futures dipped while yields and the US dollar gained ground. In the previous trading session, crude oil faced a reversal of its initial gains due to another shutdown of a Libyan oil field, closing approximately 30 cents per barrel lower.

The Energy Information Administration (EIA) further contributed to market dynamics, reporting a smaller-than-expected draw for crude oil and significant builds in diesel and gasoline, which implies weak crude demand. EIA data shows the highest surge in US gasoline stocks since 1993 last week, with a remarkable increase of 11 million barrels. However, by the year-end, inventories only exceeded the ten-year average by 4 million barrels. WTI and Brent were on track to conclude the first week of 2024 with gains of $1.3 per barrel and $1.1 per barrel, respectively.

According to a Reuters survey, OPEC’s oil output increased in December, primarily due to higher production in Iraq, Angola, and Nigeria. This uptick countered the ongoing cuts by Saudi Arabia and other OPEC+ members aimed at supporting the oil market. In December, OPEC pumped 27.88 million barrels per day, a 70,000 bpd increase from November, but still down significantly compared to the previous year.

The Red Sea Conflicts

The global shipping industry faces uncertainty as the shipping giant Maersk extended its Red Sea shipping diversion “until further notice.” This decision came amidst ongoing heightened risks in the region, as security concerns remained at a “significantly elevated level.”

On December 19, the United States launched a multinational operation aimed at safeguarding commerce in the Red Sea. However, many shipping companies and cargo owners continue to divert vessels around Africa due to ongoing attacks. The trip around Africa can add about 10 days to journey times and requires more fuel and crew time, jacking up shipping costs.

On Thursday, January 4, 2024, Maersk rerouted four out of five southbound container vessels that had already passed through the Suez Canal back north for the long journey around Africa. The Suez Canal is used by roughly one-third of global container ship cargo, and re-directing ships around the southern tip of Africa is expected to cost up to $1 million extra in fuel for every round trip between Asia and Northern Europe.

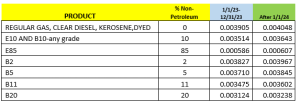

The Superfund Rate for 2024

A significant change has taken place in the Superfund excise tax rate for 2024.

The tax rate has been adjusted to increase from 16.4 cents per barrel to 17 cents per barrel, effective from January 1, 2024. It’s worth noting that this tax applies specifically to the petroleum portion of the product. As a result of this adjustment, the per-gallon rates for common blends will be recalculated to reflect the updated Superfund excise tax rate for 2024.

Reinstated by the Inflation Reduction Act in 2023, the Superfund excise tax applies to domestic crude oil and imported petroleum products.

Prices in Review

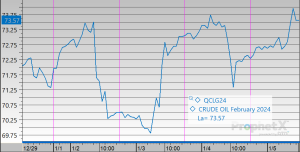

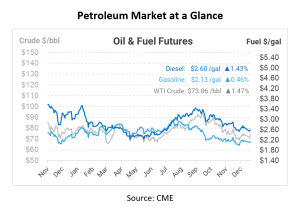

Crude opened the week at $73.51, dipping to $70.67 on Wednesday, followed by an increase on Thursday, reaching $73.39. This morning, crude oil opened at $73.96, an increase of $0.45 or 0.61%.

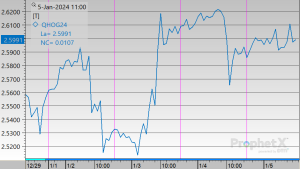

Diesel opened the year at $2.5831 and increased to $2.5922 on Wednesday. Thursday saw another rise to $2.6160. This morning, diesel opened at $2.5978, a decrease of $0.0053 or approximately 0.20% compared to the beginning of the week.

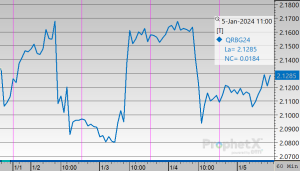

On Tuesday, gasoline opened at $2.1082, continued to fall during the day, and saw a slight increase on Wednesday, opening at $2.1369. On Thursday, it experienced a new dip to $2.1401. This morning, gasoline opened at $2.1292, marking a decrease of approximately $0.0219 or about 1.04% .

This article is part of Week in Review

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.