New Year, New Highs: Oil Prices Surge Amidst Red Sea Tensions and Chinese Demand Optimism

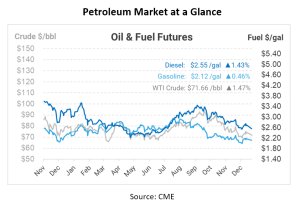

Crude oil made an impressive start to the new year, surging by approximately $1.58 per barrel, reaching $78.62/b, during the early morning session. Simultaneously, U.S. West Texas Intermediate (WTI) recorded gains of $1.56 or 2.2%, settling at $73.21 per barrel. This upward momentum was a continuation of a strong overnight performance fueled by several influential factors that are significantly impacting the global energy landscape in 2024.

At the forefront of this price surge is the escalating geopolitical tension in the Red Sea region. Recent reports revealed that the U.S. military took decisive action against Houthi forces, sinking three of their warships in the Red Sea. This response was prompted by a brazen attack on a Maersk container vessel, which has intensified concerns about the potential eruption of a broader conflict in the region. Adding to the tension, Iran deployed a warship in the Red Sea, further heightening anxieties over possible disruptions to the critical waterways used for global oil transportation. These developments have cast a significant shadow of uncertainty over supply routes and elevated fears of oil supply disruptions.

Amidst these concerns, another crucial factor driving the surge in oil prices is the optimism surrounding Chinese demand. Despite prevailing worries about global economic growth, China has committed to implementing robust economic stimulus measures, fueling hopes of increased oil demand in the world’s second-largest economy. December saw China’s manufacturing activity shrink for the third consecutive month, prompting expectations of fresh economic stimulus measures. The possibility of these measures coming into play has the potential to boost oil demand, providing essential support to crude oil prices.

As we look ahead to 2024, a recent Reuters survey of economists and analysts sheds light on their outlook for oil prices. The survey indicates that international oil prices are poised to remain close to $80 a barrel throughout the year. This forecast takes into account expectations of weak global growth, which could potentially limit oil demand. However, it also acknowledges the unpredictable nature of geopolitical tensions, which might continue to keep oil prices volatile and potentially offer support in the event of escalations.

Furthermore, the survey underscores the uncertainties surrounding OPEC+ and its ability to maintain supply cuts. Recent agreements among OPEC+ members to implement voluntary output reductions in early 2024 have raised questions about the group’s commitment, particularly in the face of fluctuating oil prices and evolving market dynamics.

In summary, the first trading session of the new year witnessed a substantial surge in oil prices, driven by escalating geopolitical tensions and the prospect of increased Chinese demand. As we progress further into 2024, the oil market remains susceptible to geopolitical developments. Analysts anticipate that these factors will continue to keep oil prices on a roller-coaster ride throughout the year, exerting significant impacts on economies and industries worldwide.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.