Week in Review – December 22, 2023

Please note that there will be no articles published on FUELSNews next week. Regular publishing will resume on January 2, 2024. We wish all our readers a wonderful holiday season!

In the dynamic world of the global energy market, recent events have significantly impacted crude oil prices, with a particular focus on prompt crude futures. Prompt crude futures, trading 60 cents per barrel higher following an overnight rally of $1 per barrel, have taken center stage. This surge in prompt crude futures reflects the market’s responsiveness to a complex web of factors, each playing its part in shaping the price trajectory of the commodity.

Amidst these price movements, yesterday’s trading saw a significant drop in crude oil prices, with a decline of approximately 50 cents per barrel. This decline came as the market grappled with a crucial dilemma, weighing the ongoing Red Sea shipping risk against record-breaking U.S. crude production levels. The interplay between these factors has been instrumental in dictating price trends in the recent volatile environment.

Adding to this intricate equation, Angola, a significant player in the oil-producing landscape, delivered a pivotal announcement. Angola’s decision to exit OPEC echoed through the market, potentially contributing to the downward pressure on prices. This move by Angola was driven by the assertion that continued membership in the organization no longer served its interests. It was a decision born out of a clash of priorities, particularly in light of the country’s previous protests against the 2024 OPEC+ production cuts.

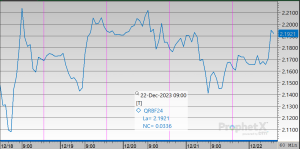

Over the course of the past week, prompt crude prices have embarked on a roller-coaster ride, fluctuating within a range of approximately $5 per barrel. Both West Texas Intermediate (WTI) and Brent crude futures have seen overall rallies, driven in part by the unsettling news of Red Sea shipping disruptions, which have triggered logistical concerns in the market.

These price fluctuations, while significant, are part of a larger narrative. Crude oil prices have been on a quest to reclaim lost ground, emerging from the shadows of last week’s near five-month lows. This week’s performance has been particularly noteworthy, as prices have been on track for the largest weekly gain seen in two months.

However, it’s important to maintain perspective. Despite these recent gains, both Brent and WTI crude oil prices remain lower by approximately $2 to $3 per barrel when examined from a month-to-date standpoint. The market’s journey is punctuated by periods of turbulence and recovery, reflecting the intricacies of supply and demand dynamics, geopolitical events, and market sentiment.

Prices in Review

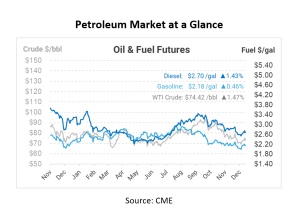

Crude opened the week at $73.48. By Tuesday, there was a slight uptick to $73.60, followed by a more significant increase to $74.61 on Wednesday. This morning, crude oil opened at $74.65, an increase of $1.17 or 1.59%.

On Monday, Diesel opened at $2.7003, and it further increased to $2.7130 on Tuesday. Wednesday saw another rise to $2.7415, but Thursday witnessed a slight decline to $2.6977. This morning, diesel opened at $2.7049.

On Monday, gasoline opened at $2.1886, dipped slightly during the day, and began Tuesday at $2.1892. It showed an increase on Wednesday, with an opening price of $2.1935. However, Thursday saw a dip to $2.1592. This morning, gasoline opened at $2.1959, marking an increase of approximately $1 cent or about 0.33%.

This article is part of Week in Review

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.