Week in Review – December 8, 2023

Oil prices are facing a significant challenge as they head for a seven-week decline, a pattern not seen in half a decade. Brent crude futures were trading at $75.56 a barrel, up $1.51 or 2%, while U.S. West Texas Intermediate (WTI) crude futures stood at $70.76 a barrel, marking an increase of $1.42 or 2%. Despite this temporary rebound, concerns over a supply surplus and weakening Chinese demand continue to exert downward pressure on oil prices.

The primary driver behind the current slump in oil prices is the sharp decline in Chinese crude oil imports. In November, these imports fell by a significant 9.2% year-on-year, marking the first annual decline since April. Several factors contribute to this decline:

- High Inventory Levels: China started the month of November with substantial onshore crude inventories, estimated at 958 million barrels. These high inventory levels have reduced the immediate need for additional imports, putting downward pressure on oil prices.

- Weak Economic Indicators: Weakness in China’s manufacturing and construction sectors has led to decreased demand for oil products such as diesel and asphalt. The manufacturing PMI shrank for the second consecutive month in November, reflecting diminishing confidence in government stimulus measures among factory managers, which has affected prices.

- Competitive Teapot Refineries: Independent “teapot” refineries in Shandong faced competition for Russian and Venezuelan crude cargoes, despite declining international crude benchmarks. The relaxation of U.S. sanctions on Venezuela led to a broader range of offer prices, making it challenging for teapot refineries to secure cost-effective deals, further impacting oil prices.

Another significant factor contributing to the oversupply of oil is the ongoing record-high crude production in the United States. According to the U.S. Energy Information Administration, U.S. crude output remains above 13 million barrels per day. This substantial production level adds to the global glut of oil, further pressuring prices downward.

In response to the declining prices, Saudi Arabia and Russia, the world’s two largest oil exporters, have been urging all OPEC+ members to implement output cuts. OPEC+ recently agreed to reduce production by 2.2 million barrels per day for the first quarter of the coming year. However, skepticism remains about the effectiveness of these efforts, with analysts suggesting that the actual production reductions may be limited, given factors like quota baselines and dependence on hydrocarbon revenues among OPEC+ members.

Despite temporary rebounds, the underlying issues of surplus supply and weak demand continue to weigh on the market. Investors are closely watching the U.S. job report for November, as strong employment data could boost demand expectations and potentially provide some support to oil prices.

Prices in Review

Crude oil prices displayed notable fluctuations this week, starting at $74.38 on Monday. However, by Tuesday, it had dipped by approximately 97 cents to reach $73.41. The most significant drop occurred on Wednesday when crude oil hit a low of $69.34. This morning, the price showed a modest recovery, opening at $70.87, but it still remained $3.51 lower than Monday’s starting point.

Diesel prices opened at $2.684 on Monday. By Tuesday, it had shown a slight recovery, opening at $2.691. This morning, diesel opened at $2.603, reflecting a decrease of 8 cents or approximately -3.02% compared to Monday’s opening price.

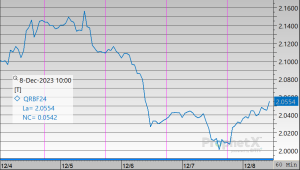

Gasoline opened on Monday at $2.134 and rose by 22 cents to reach $2.156 on Tuesday. However, the price dipped to $2.026 on Wednesday before experiencing a slight recovery to $2.041 on Thursday. This morning, gasoline opened at $2.054, representing a decrease of 8 cents or approximately -3.75% when compared to Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.