Week in Review – December 1, 2023

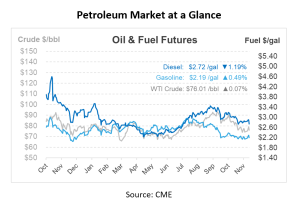

Despite OPEC and its allies agreeing to new production cuts at their virtual meeting this week, crude and refined product futures closed lower on Thursday. WTI crude traded over $2/bbl higher with the initial announcement of OPEC’s decision. Later specifications of the production cut volumes led to a drop of approximately $4/bbl, with WTI closing $1.90/bbl lower and Brent $2/bbl lower. This morning, crude is trading up, but only by about 5 cents at $76/bbl.

Seven OPEC countries, including Saudi Arabia, announced additional voluntary production cuts for the first quarter of 2024, approaching 2 mbpd. Saudi Arabia notably extended its 1 mbpd unilateral cut through this period. This includes Russia’s increase in their current export cut from 300 kbpd to 500 kbpd, focusing the new 200 kbpd in cuts on refined products exports rather than crude exports.

Interestingly, Angola, an OPEC member, has publicly rejected OPEC’s production cuts, indicating its intention to produce more than its stated limits. Brazil also made an announcement to join the OPEC Alliance Charter in a non-binding move starting in January 2024, adding another layer to this complex scenario. The next OPEC meeting, scheduled for June 2024, will be instrumental in determining 2024 output levels.

Looking ahead, Goldman Sachs Investment Research (GIR) reiterated their forecast for Brent oil prices to be in the $80-$100 range in 2024, following OPEC+’s announced cut. However, they also acknowledged risks leaning towards the downside, particularly due to unexpected increases in inventories and non-OPEC supply.

Today, Bloomberg reported on Russia’s strategy to enhance its diesel exports from major Western ports in December. This increase, amounting to more than 25%, follows the Russian government’s decision to relax export restrictions. Adding to the decision, recent storms in the Black Sea, which delayed the November fuel loadings, have warned of potential supply concerns. As a result, Russia’s diesel exports are projected to increase to 681,000 bpd marking a substantial 28% rise from the previous month.

Prices in Review

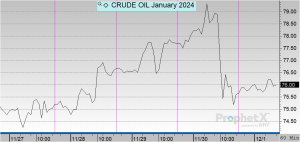

Crude opened on Monday at $75.31, dropped off about 24 cents on Tuesday and increased slightly the rest of the week. This morning, crude opened at $75.59, an increase of 28 cents or 0.372%.

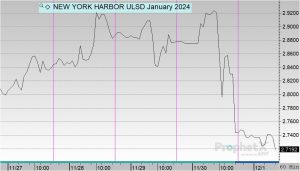

Diesel opened at $2.823 on Monday and saw increases both Tuesday and Wednesday before retreating slightly on Thursday. This morning, diesel opened at $2.743, a decrease of 8 cents or (-02.83%).

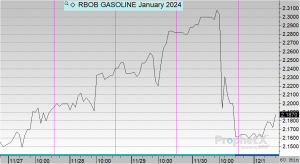

Gasoline opened the week on Monday at $2.1635 before increasing the next three days. This morning, gasoline opened at $2.1615, a drop of less than one cent.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.