OPEC’s Power Play and Its Domino Effect on Oil Prices and Reserves

OPEC delayed their recently scheduled meeting to this Thursday, which is shaping up to be one of the most impactful in the last decade. There is high anticipation of potential production cuts by the group, and these speculations have caused a domino effect on recent crude futures price fluctuations.

Significantly influencing the OPEC discussions is the stance of Saudi Arabia, who has proposed that other member countries reduce their output quotas. This proposal has not been met with a unanimous agreement, leading to a lack of consensus among the members. The discord within OPEC has contributed to the delay of the meeting, originally centered around setting production targets for 2024.

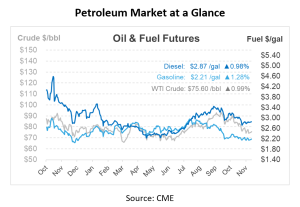

The uncertainties and disagreements within OPEC have had a direct impact on crude oil futures. In response to the potential production cuts and the delay in the meeting, crude oil futures have experienced some volatility. After a four-day price downturn, which was a reaction to the delayed meeting, crude oil futures saw an increase this morning by over 70 c/bbl. This uptick reversed yesterday’s drops, where prices fell by over 50 c/bbl. Brent calendar spreads for January and March have seen a dramatic shift from a backwardation of about $4/bbl in September to just around 40 cents. This change suggests that the market anticipates a comfortable supply in the first quarter of 2024, even if OPEC decides to extend its production cuts.

External factors are also influencing the crude oil market. A recent storm in the Black Sea has caused significant disruptions, leaving half a million people without power in Crimea and interrupting crude loadings at Russia’s Novorossiysk terminal. The resumption of operations at this terminal is contingent on improved weather conditions.

Strategic Petroleum Reserve refill efforts are facing delays due to companies postponing the return of borrowed barrels. Specifically, three companies have been granted approval to delay returning 5 million bbls until 2024 and 2025. These barrels are crucial for the Energy Department’s strategy to replenish the stockpile, which has been at its lowest since the 1980s. The Department’s attempts to purchase crude for the reserve directly have been hampered by disagreements over price and quality, leading to the cancellation of two bids to buy a total of 9 million bbls this year. To date, the U.S. has only acquired 7.5 million barrels of the 12 million it aimed to purchase this year.

Diesel inventories are another growing concern, particularly in the Northeast. Above-normal temperatures this fall have kept demand in check. But, with forecasts predicting below-normal temperatures for Northwest Europe in early December, we might see a spike in consumption. On the trading front, buyers seem reluctant to agree to higher prices, as observed in the minimal increase of the NYMEX December ULSD contract, which edged up by just 22 cents to $2.8379 per gallon.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.