Déjà vu on the East Coast: Supply Challenges Resurface with Warning Signs of Outages

Just over a year ago, FUELSNews covered East Coast supply challenges from steep backwardation to shrinking diesel inventories and rising exports. Familiar patterns are reemerging this year, and once again those patterns are the result of market dynamics, not more acute challenges like natural disasters or pipeline malfunctions. The overall pattern could suggest a lack of supply to meet the demand – hinting at a possible repeat of last year’s supply shortages.

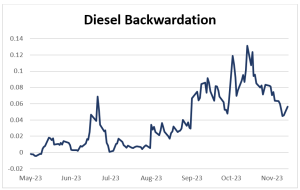

Market Backwardation Returns

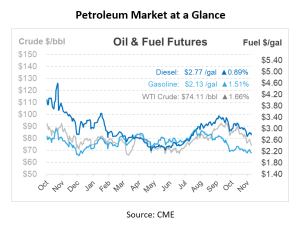

The diesel futures market is currently experiencing an increase in backwardation, similar to what was observed last year. Although the current levels of backwardation are not nearly as high as those seen last fall, they are the most significant since the summer driving season and continue to escalate. Backwardation, a market condition where near-term prices are higher than those in the future, results in increased costs for shipping on pipelines and holding inventory. This situation escalates the risk for fuel shippers and could lead to supply shortages similar to those experienced last year. Colonial Pipeline’s allocation on line 2, which is dedicated to diesel, is restricting the volume that can be transported, further complicating the situation.

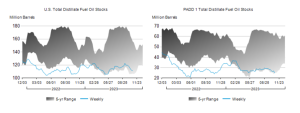

Falling Diesel Inventories

Diesel inventories have been declining for weeks, reaching historically low levels for this season. Right now, diesel inventories are sitting below 120 million barrels, roughly the same levels seen this time last year. In PADD 1, the East Coast, inventories are below 30 million barrels. Despite patchy demand due to high prices, these low inventories are a cause for concern. As we’ve seen, even minor supply disruptions, such as refinery outages or extreme weather, can escalate into major challenges under such conditions.

Strained East Coast Markets

Mirroring last year’s scenario, the up/down dynamics on the East Coast are again causing supply shortages in states such as Tennessee, Kentucky, and Virginia. High prices up north are leading shippers to move product past the Southeast and directly to the north, resulting in tighter supplies further south. Some areas are starved that were already on Just-In-Time inventory levels. These “fringe” areas, far from the Colonial Pipeline’s source, are experiencing delayed resupply, highlighting the fragility of the current supply chain.

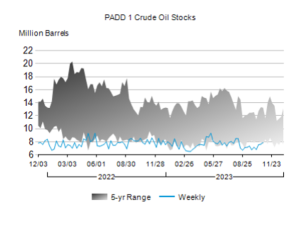

PADD 1 Inventory Levels

PADD 1 inventories remain worryingly low. Additionally, the lower crack spreads are discouraging refineries from maintaining high production levels, reducing their operational flexibility and exacerbating supply concerns.

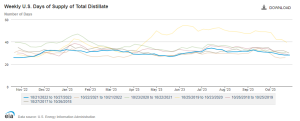

The nation as a whole has about 28 days of diesel supply, meaning if refineries halted production the US could last 28 days on current inventories. In October of 2022, this number reached a 30 year low of 25.9 days of supply. While not at alarming levels of supply, the current inventory levels in PADD 1 only add worry to the East Coast supply tensions.

What Could Make Matters Worse?

For one, the threat of a cold front moving in could cause an uptick in diesel demand. Cold weather increases the demand for heating oil and could strain the already tight market, pushing it towards a crisis. Ongoing market backwardation in the market could also increase shipping costs on the Colonial pipeline, making it less profitable and, hence, less attractive for shippers, potentially leading to further supply shortages. This phenomenon can cause a domino effect in other markets. Additionally, any changes in European supply, such as those due to the Russia-Ukraine crisis, could necessitate more exports / fewer imports for the US, straining markets in the Northeast.

The recent shortages in the Southeast have the feeling of a canary in the coal mine – suggesting that future problems could arise. Of course, markets today are stable, and markets have enough product to meet demand most of the time.

You may be wondering if we are on the brink of another East Coast supply crunch this winter. Current market dynamics and supply patterns are strikingly similar to last year, but there are resupply efforts taking place in the strained areas of supply, and refineries are coming off of seasonal maintenance routines. There’s no cause for panic yet – prudent buyers should monitor the signs to determine the best steps for their business. If your fuel program is critical to your business operations – then be sure you have a plan this winter if prices spike or supply thins.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.