Week in Review – November 10, 2023

Crude futures are trading approximately 75c/bbl higher, reversing losses incurred throughout this week. Middle East tensions are partly to attribute to this increase as global headlines point toward escalating conflicts. Yesterday, prompt crude closed over 40 c/bbl higher, as the market views crude as being oversold. For the first time since July, the Dec 23/Jan 24 WTI prompt spread closed at a discount, settling three c/bbl lower. This shift indicates expectations of an oversupply in the near-term crude market, especially after the American Petroleum Institute (API) reported an estimated build of 11.9 million bbls in U.S. crude inventories last week, and Genscape reported a build of 2.5 million bbls at Cushing.

Global crude demand expectations are diminishing according to several indicators. This is evident as state and independent refiners in China have reduced their run rates to 76% and 56.6% of capacity, respectively, as of November 10th, marking the lowest level since May 2022. The expected decline in crude demand is becoming more apparent, with Chinese refineries requesting less supply from Saudi Arabia for December.

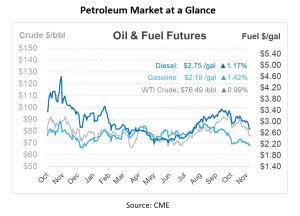

Crude demand is not the only thing on the decline. Diesel demand has decreased recently following the end of the crop harvesting season, reducing the need for diesel fuel among farmers. Diesel futures are proving this diminished demand with a drop of over 20c/gallon, reaching their lowest point in several months. Also contributing to this trend are forecasts of warmer weather this winter. Weak demand from the trucking and manufacturing sectors is another factor pulling down diesel prices, along with increasing stockpiles as U.S. refiners wrap up their maintenance season. The EIA anticipates that per capita road fuel demand in 2024 will drop to its lowest level in twenty years.

This week, the EIA released its Short-Term Energy Outlook (STEO), forecasting an increase in the production of liquid fuels, estimating an increase of 1 million bpd in 2024. This growth, however, is being partially counterbalanced by the ongoing production cuts implemented by OPEC+. Alongside these cuts, the production increases from non-OPEC countries are expected to contribute to a balanced global oil market in the next year.

Turning to U.S. gasoline consumption, there is an anticipated decline of 1% in 2024, which would mark the lowest per capita consumption in the last two decades. Several factors are driving this decrease. The rise in remote working arrangements, advancements in fuel efficiency within the U.S. vehicle fleet, high gasoline prices, and ongoing high inflation rates collectively reduce the per capita gasoline demand in the country.

Prices in Review

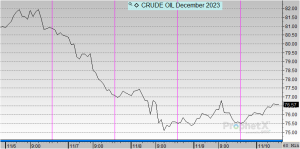

Crude opened the week at $81.13 before falling for the rest of the week. This morning, crude opened at $75.59 accounting for a decline of over $5 (-6.83%).

Diesel opened the week at $2.9209, gained a few cents on Tuesday, and then experienced losses for the remainder of the week. This morning, diesel opened at $2.7178, a decrease of about 20 cents (-6.953%).

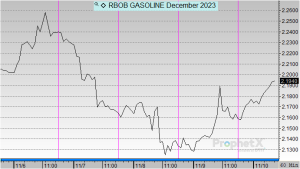

Gasoline opened the week at $2.2036, showed minimal gains on Tuesday, and three days of losses before posting marginal gains this morning. Today, gasoline opened at $2.1642, a decline of about 4 cents (-1.787%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.