Week in Review – November 3, 2023

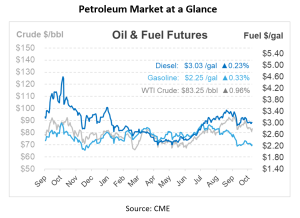

With a softer U.S. dollar at play and an increased risk premium from the Middle East, investors have been more bullish over the past few days. Crude oil futures are trading up this morning over 70c/bbl after settling higher yesterday as well. Geopolitical worries emanate from the Middle East, with market eyes fixed on Hezbollah’s leader, Hassan Nasrallah, and the potential repercussions his speech later today might have on regional stability.

A weaker US dollar traditionally offers support to commodity prices, making them cheaper for holders of other currencies. The anticipation ahead of the October payrolls report, with predictions of a 195k nonfarm payroll increase, has done little to strengthen the dollar, which in turn has provided an indirect boost to crude prices.

WTI and Brent, two benchmarks for crude oil prices, have reversed Wednesday’s losses, banking $2.02/bbl and $2.22/bbl, respectively, on uncertainty surrounding the geopolitical tensions and presumptions of the Fed pausing rate hikes. The Dec23/Jan24 WTI spread’s dip by 33c/bbl is a subtle indicator of looser physical balances following a report by the EIA indicating an increase of 0.8 million barrels in U.S. crude stockpiles and a 0.3 million barrels rise in inventories at the Cushing storage hub. Despite the escalating tensions following the Israel-Hamas conflict, actual supply disruptions have been surprisingly minimal, with inventory levels rising due to a mix of weaker refinery demand and mild demand indicators from major economies like China and Europe. Crude prices are on track for a second week in a row of losses after a three-week period of gains.

Russian oil exports from western ports are set to exceed expectations in November to almost 2.3 million bpd, suggesting a slight decrease from October. This revision comes against the backdrop of anticipated high refinery runs and increased export plans by several companies. Post-maintenance, refinery activity in Russia is poised to increase, adding another layer to the global supply narrative.

On the other side of the world, China’s independent refineries are facing a supply crunch due to a lack of crude import quotas. This has already led to a sizeable decrease in their throughput. Since the beginning of the month, there has been a week-over-week decline of 1.98% in the average operating capacity of independent refineries, dropping to 65.5% as a result of smaller refining margins. While independent refineries reduced their feedstock imports by 1.1% in October compared to September, the year-over-year figure remains 8.1% higher. The import quota conundrum is expected to persist until the new allotments for 2024, pressuring refining margins and influencing global crude flows.

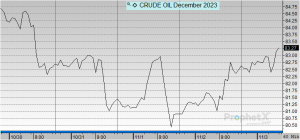

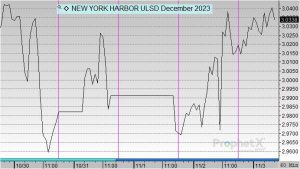

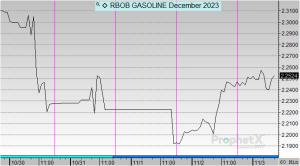

Prices in Review

Crude prices opened on Monday at $85 before dipping off over the next few days. This morning, crude opened at $82.60, a decrease of $2.40 (-2.823%).

Diesel opened on Monday at $3.0369 and continues to decrease with a third consecutive daily drop. This morning, diesel opened at $3.0188, a decline of almost 2 cents or -0.596%.

Gasoline opened on Monday at $2.306 and, after a three-day decline, have seen a slight increase, but not enough to mark a weekly gain. This morning, gasoline opened at $2.2446, a drop of around 6 cents or -2.663%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.