Week in Review – October 27, 2023

As this week nears its close, crude futures have traded up approximately $1/bbl this morning, reversing some of yesterday’s losses. Crude prices started rallying earlier today amid the increasing risks of the Israel-Hamas conflict escalating to a broader conflict in the Middle East. This comes after the US conducted strikes on two Iran-linked facilities in Syria, and Israel sent troops on a limited raid into Gaza for the second consecutive night.

Yesterday, the US government reported that GDP expanded at a 4.9% annual rate in the third quarter, surpassing most economists’ expectations. Although the US central bank decided not to change the benchmark interest rate in September, the signs of an overheating economy could prompt a resumption of rate hikes.

The combination of rising long-term interest rates, geopolitical tensions, and a possible US government shutdown could pose challenges for the economy, potentially weakening crude demand. Despite these challenges, the global oil supply has continued to tighten, even with record production by US shale.

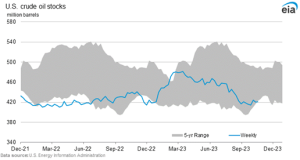

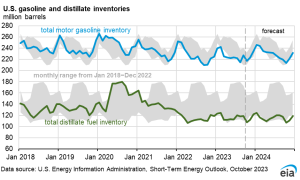

The latest weekly data from the Energy Information Administration (EIA) was highly bullish, showing that crude oil inventories fell by 4.49 million barrels to 419.75 million barrels. This drop takes the deficit below the five-year average to 20.91 million barrels. In the WTI pricing hub at Cushing, Oklahoma, crude oil inventories fell by 0.76 million barrels, reaching a nine-year low of 21.01 million barrels. Low crude inventories at the Cushing, Oklahoma refinery are a cause for concern in terms of crude supply, narrowing the crack spreads. Diesel fuel, however, is in a “just-in-time” inventory status.

Meanwhile, gasoline inventories fell by 2.37 million barrels to 223.90 million barrels, reducing the surplus above the five-year average to just 0.40 million barrels. Total demand climbed by 2.231 million bpd to 21.897 million bpd, and gasoline demand increased by 362,000 bpd to 8.943 million bpd.

Prices in Review

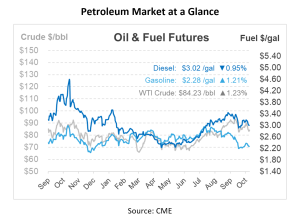

Crude oil began the week at $88 on Monday before teetering off the rest of the week. This morning, crude opened at $83.53, accounting for a drop of $4.47 (-5.08%).

Diesel also experienced some relief this week after opening on Monday at $3.1566. This morning, diesel opened at $3.05, a decrease of 10 cents (-3.377%).

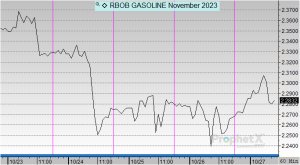

Gasoline opened the week at $2.3657, also experiencing a week of price drops. This morning, gasoline opened at $2.2686, a decline of nearly 10 cents (-4.104%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.