Oil Market’s Rollercoaster: Israel-Hamas Tension and Trader Sentiment in Play

Recently, prompt crude futures experienced an increase of roughly 20 cents per barrel, bouncing back from earlier declines caused by disappointing business activity data in the Eurozone. However, the most significant influence on oil prices has been the ongoing Israel-Hamas conflict.

Diplomatic efforts to address the crisis in the Middle East have led to a reduction in the geopolitical risk premium, causing oil prices to dip. Reports suggesting potential prisoner releases by Hamas have delayed the risk of a ground invasion of Gaza by Israel. Furthermore, Israel has pledged to deliver fuels and humanitarian aid to the Gaza Strip, and President Biden has hinted at the possibility of negotiating a ceasefire in exchange for hostages. These developments have added an element of uncertainty to oil prices.

Investor activity has also played a significant role in recent oil market dynamics. According to the CFTC’s Commitment of Traders report, after three weeks of significant selling, portfolio investors cautiously returned to the petroleum market. Their return coincided with escalating conflicts in the Middle East that threatened to disrupt crude oil supplies. Hedge funds and money managers purchased a total of 10 million barrels across crucial futures and options contracts.

Notably, there has been a significant shift from NYMEX and ICE WTI to the more European / global contract, Brent crude, indicating investor concerns about potential crude supply disruptions in the Middle East. This move marked the most substantial weekly increase in Brent buying in nearly seven years. The geopolitical risk premium embedded in oil prices has led investors to closely monitor developments in the Middle East, with expectations that this risk could subside in the coming weeks.

In addition to geopolitical factors, the International Energy Agency (IEA) recently released its 2023 World Energy Outlook report. The report predicts that global demand for coal, oil, and natural gas will peak before 2030, primarily driven by the rise in electric vehicle sales and China’s slowing economic growth. The IEA highlighted China’s economy as being at an inflection point, with slowing growth posing potential downside risks for fossil fuel demand.

The report also emphasized that if China’s growth continues to decelerate, oil imports could decline by 5%, and LNG imports could plummet by over 20%. The IEA’s long-term projection suggests oil consumption peaking at 102 million barrels per day in the late 2020s, gradually declining to 97 million barrels per day by 2050.

Meanwhile, the IEA assessed the adequacy of strategic oil reserves, concluding that current levels within member states are sufficient to stabilize oil markets if required. There is no immediate need to increase strategic reserve requirements, according to the agency. While geopolitical tensions in the Middle East have raised concerns, the IEA believes that the current reserves, equivalent to at least 90 days of net oil imports, should provide market confidence.

However, some countries are taking additional measures to bolster their stockpiles, with the U.S. planning to purchase 6 million barrels of crude oil for the Strategic Petroleum Reserve. The IEA remains vigilant, emphasizing the importance of monitoring future developments in the oil market.

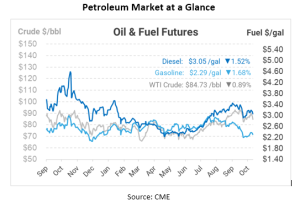

From a technical standpoint, U.S. oil faces potential resistance at $86.55 per barrel, with the possibility of breaking above this level and reaching $87.54. Despite recent fluctuations, the oil market remains volatile, driven by a complex interplay of geopolitical events, economic data, and shifts in investor sentiment.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.