US Refinery Maintenance Reaches Highest Levels Since 2019

The fall refinery maintenance season in the United States is currently underway and shaping up to be the heaviest since before the COVID-19 pandemic forced plants to reduce production rates and delay non-emergency maintenance work. According to data from Energy Aspects LTD, nearly 2.5 million barrels a day of refining capacity will be taken offline for maintenance from September through December, marking an 11% increase compared to the same period last year.

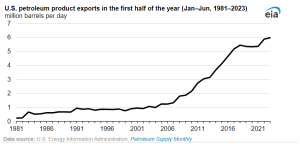

As the capacity for refining oil decreases, new data from the Energy Information Administration (EIA) reveals that the United States exported nearly 6 million barrels of petroleum products each day in the first half of this year. This marks a 2% increase from the same period in 2022.

However, despite this growth in exports, the EIA points out that petroleum production in the first half of 2023 increased more slowly than in the first half of 2022. The reason for this difference is that in 2022, production quickly ramped up to meet rising demand in Europe after the region took steps to reduce its reliance on petroleum product imports from Russia.

Higher Maintenance in 2023

Refinery maintenance is an essential aspect of the petroleum industry. It involves shutting down various units within a refinery to inspect, repair, and upgrade equipment and infrastructure. Typical maintenance tasks include cleaning and replacing equipment, checking for corrosion, addressing safety issues, and implementing technological upgrades to enhance efficiency and environmental compliance.

This process is crucial for ensuring the safe and reliable operation of refineries, as it helps prevent unplanned outages and reduces the risk of accidents. Routine maintenance is usually planned to coincide with periods of lower demand, such as the fall season, to minimize disruptions to fuel supply.

This year, refineries are facing higher-than-usual maintenance due to several factors, such as the COVID-19 pandemic disrupting the regular maintenance schedules, leading to a backlog of necessary work that is now being addressed. The current packed maintenance schedule is a result of several factors, including repairs on units affected by unplanned leaks, multiple fires, and the overall strain of operating at maximum capacity during an unusually hot summer. Refiners are also grappling with a backlog of turnarounds after postponing maintenance to cut costs during the pandemic and, later, to chase stronger profit margins as the economy improved.

Fuel Inventory Concerns

With nearly 2.5 million barrels a day of capacity temporarily offline, questions arise about whether there are enough fuel inventories to cover the demand during this maintenance period. Fuel inventory levels vary by region, but they are typically monitored closely to ensure that supply meets demand.

In preparation for maintenance seasons, refiners often build up stockpiles to mitigate supply disruptions. Government agencies and industry organizations also play a role in managing fuel reserves and coordinating supply during periods of high maintenance. However, unexpected disruptions or prolonged maintenance could strain these reserves.

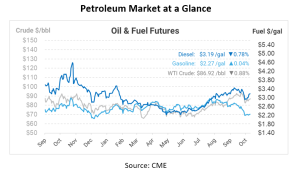

For fuel buyers, the increased maintenance activity could lead to some short-term challenges. While the central portion of the company has adequate fuel inventories, coastal markets have multi-year lows of fuel inventories, especially diesel. The most immediate concern is the potential for localized fuel shortages in regions heavily reliant on refineries currently undergoing maintenance. A surge in demand, perhaps from cold weather, could send supplies spiraling lower. If supply disruptions occur, prices at the pump could rise temporarily in those areas.

Looking ahead, early 2024 may bring even more significant maintenance challenges, potentially surpassing the current season’s intensity. Refinery operators and industry stakeholders will need to work together to balance the need for maintenance with the demand for fuel, ensuring a stable energy supply for the United States.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.