Week in Review – October 13, 2023

Geopolitical conflicts have been the topic of the week, with war breaking out in the Middle East between Israel and Hamas this past weekend. Adding to market tensions, today the US imposed sanctions on two companies for transporting Russian crude oil. Risky events bring volatile markets, and that’s exactly what we’ve seen this week. Let’s dive into the key themes this week that kept markets on edge.

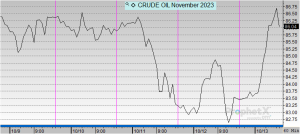

Markets have grappled with the implications of the Israel-Hamas conflict, which we covered in depth yesterday. The key question is how the conflict affects Iranian sanctions and Saudi Arabia’s production decisions. In both cases, the risks are bullish, so the up-and-down swing from Monday through Wednesday reflects the market’s knee-jerk fear followed by calmer, lower-risk expectations.

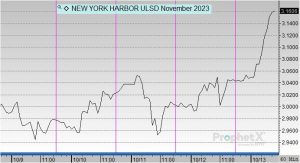

This morning, prices are once again rocketing higher, with crude up +$3 and diesel seeing over ten-cent gains. The US is cracking down on Russian oil, sanctioning two companies (based in Turkey and the UAE) that carried Russian oil at values above the $60 cap. Russia’s crude exports have been declining, though fuel exports have brought up their total crude and refined product export levels. Although exports haven’t directly slowed, US Treasury officials have pointed out that the sanctions have forced Russian to deploy a “ghost fleet” of oil tankers, raising the cost to get oil to China and India. That means Russia pays more for transportation costs and has less remaining profits; as one official noted, expenses go to “tankers not tanks.”

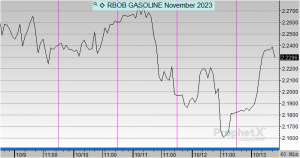

Both crude and gasoline futures recorded a drop on Thursday. This decline came on the back of the U.S. government’s announcement of a significant increase in oil inventories. The upswing in stocks counteracted the anticipation that the Federal Reserve might halt its interest rate hikes.

This week’s EIA inventory report showcased a ten million bbl increase in U.S. crude inventories, suggesting a potential ease in the U.S. market’s tightness. This report was further bolstered by the EIA’s monthly Short-Term Energy Outlook, which reported that U.S. gasoline demand in September plummeted to a 20-year low, hinting at a diminishing oil demand. The U.S. crude production rate rose, achieving a record-breaking 13.2 million bpd. Such developments translated to a decrease in the Nov 23/Dec 23 WTI spread, echoing the move toward a lower flat price.

The EIA also projects a dip in global oil inventories by 0.2 million bpd in the second half of 2023, owing to Saudi Arabia’s voluntary production cuts and OPEC+ countries’ trimmed production goals. This, in turn, could exert an upward push on crude oil prices. Projections suggest that the Brent spot price might climb to an average of $95/bbl in 2024.

Markets are currently navigating the planned seasonal refinery downtime, which has led to diminished refinery utilization. This expectedly results in a crude build-up; however, a continued slump in gasoline demand may pressurize the crack spread. If this pressure persists, some Midwest refiners might consider scaling back production, prioritizing profitability over production volume.

Prices in Review

Following a spike during weekend trading, crude opened the week at $85.25 before rising slightly on Tuesday. This morning, crude opened at $83.51, a decline of $1.74 or -2.04%. Morning trading has closed this gap, however, so the week could see net gains.

Diesel opened the week at $2.9498 on Monday and followed suit with crude in a small climb on Tuesday. This morning, diesel opened at $3.0489, an increase of nearly five cents or 3.359%.

Gasoline opened at $2.24 on Monday before declining for most of the week. This morning, gasoline opened at $2.1809, a decline of nearly six cents or -2.638%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.