Oil Markets on Edge: Expert Insights on Israel-Hamas Conflict

The recent Israel-Hamas Conflict has sent waves through global oil markets, triggering an upsurge of speculation and concern among analysts and experts. As tensions continue to mount in the Middle East, oil prices have become increasingly volatile, prompting questions about the stability of the oil supply chain and its broader impact on the world’s energy markets.

Traders and experts have been closely monitoring the situation, and there’s a growing fear that the Israel-Hamas conflict might not remain confined to its current boundaries. Many are concerned that an escalation could potentially draw in more regional players, including Tehran and even the United States.

In today’s article, we are highlighting viewpoints and analyses by different experts regarding the current situation, as reported by Bloomberg in “What Oil Watchers Have to Say About Impact of Hamas’ Attacks.”

Supply Disruption Concerns

One of the most significant concerns raised by analysts is the possible disruption to oil supplies. Should Iran be identified as an accomplice with Hamas (and the country already has ties to the group), then Israel could attack Iran directly. Direct Israeli actions towards Iran would make it difficult for the US to continue allowing sanctioned Iranian oil into the global marketplace. According to experts, any interruption in oil production or shipping routes in the region could lead to a significant impact on global oil markets. Similar sentiments were echoed by Citigroup, RBC Capital Markets, and more.

On the other hand, the risk of supply disruption is not the same as actual disruption. Bloomberg cites the Commonwealth Bank of Australia’s analyst Vivek Dhar, noting that without disruption of supplies, the market impact could fade away quickly.

Geopolitical Tension and Market Sentiment

The ongoing conflict has also sparked geopolitical tension, leading to increased market volatility. With the US deploying a significant naval presence into the region and Israel now expanding retaliatory attacks to Syrian airports, tensions are spreading. Of course, Israel, Palestine, and Syria do not produce significant quantities of oil. However, Hamas and Syria are aligned with Iran, so further escalation could lead to the US restricting Iranian oil.

Moreover, the conflict is expected to halt progress on Saudi-Israeli relations warming, with Saudi and Iranian heads of state speaking together to discuss the situation. That could leave Saudi Arabia less likely to unwind its voluntary supply cuts, potentially keeping more oil off the market for longer.

Investors are closely monitoring any developments in the region, and geopolitical tensions between major oil-producing nations can quickly spill over to impact production and supply chains. As a result, market sentiment has been on the rise, with traders closely watching for any further escalation of the conflict. As Bloomberg notes, quoting ING Groep NV, “The war-risk premium has returned to the oil market.”

Future Prices

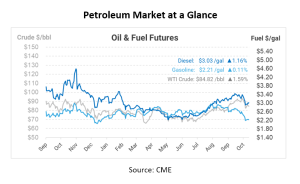

Despite the conflict, analysts are taking a “wait-and-see” approach in their expectations. Goldman reiterated its call for Brent to hit $100/bbl by June 2024, noting the upside risk but not changing their official forecast. Citigroup notes bullish implications, and Morgan Stanley sees a “likely limited” impact from the attacks, with the stipulation that things can change quickly.

Conclusion

The overall consensus from analysts is that nothing has happened to disrupt oil markets – yet. The market’s reaction this week has been largely un-done at this point, though markets are turning higher today as the conflict escalates to involve new areas. But even without a physical supply disruption, there remains a higher-than-normal risk that a disruption is coming.

For fuel buyers, now is the time to review your fuel purchases and budget and determine the impact of a large change in fuel prices. Volatility could send prices shooting higher, or markets could settle back to a lower position. Regardless, it’s important to have a plan to cover any scenario.

If you have concerns about exceeding your fuel budget, consider a fixed price to reduce your risk. With a fixed price, you’ll know your price in advance, so you don’t have to watch the market with fear.

Contact Mansfield’s risk management team to find out if a fixed price is right for you, and to learn what options you have to control risk.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.