Israel-Hamas Conflict Spurs Bullish Rush in Oil Market

Oil prices have been on a rollercoaster ride, with significant fluctuations driven by geopolitical tensions in the Middle East. Over the weekend, a coordinated offensive by the Palestinian Islamist group Hamas against Israel left hundreds of casualties, also triggering a surge in oil prices. Brent crude, the global benchmark, soared by approximately 4% to reach $88 a barrel, while West Texas Intermediate (WTI) crude increased by around 4% to approximately $86 a barrel. Additionally, natural gas prices rose over 10% in response to the situation.

Though neither Palestine nor Israel are significant players in global energy markets, their proximity to oil majors such as Saudi Arabia and Iran creates some tension. Iran has ties with Hamas – with Iran’s leaders reportedly congratulating Hamas on its victories – so there’s a risk of the conflict spilling over. In light of the conflict, oil market participants are reevaluating their positions to protect against potential supply disruptions. The CBOE volatility index, often referred to as Wall Street’s “fear gauge,” initially spiked by 7.5% in response to the heightened geopolitical tensions but moderated throughout the day. Surprisingly, U.S. stocks appeared resilient to the news, with the Dow Jones Industrial Average and S&P 500 both gaining around 0.6%, while the Nasdaq index climbed 0.4%.

Although fuel prices rose on the news of Middle Eastern tension, those gains were not comparable to crude oil’s rise. That’s driven down 3:2:1 crack spreads, a refiner’s margin, to their lowest point since before Russia invaded Ukraine. Crack spreads have fallen below $20/bbl in the past week, their lowest level since January 2022. Pre-invasion spreads typically ranged $11-$24, so it will be interesting to see whether refiners accept this new lower environment or if the spreads spring back to the $30-$50 range we’ve seen for the past few years. For consumers, low spreads could mean lower refining activity (meaning lower supply availability) but also lower fuel prices (since the premium over crude oil has been reduced).

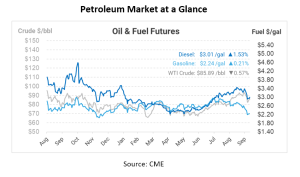

Even before the Middle East tensions, fuel prices in the United States and elsewhere have remained a source of concern for policymakers striving to manage inflation. Gasoline prices in the US currently average $3.70 per gallon, up from approximately $3.20 at the beginning of the year. These prices closely follow the fluctuations in crude oil prices, albeit with a lag of several weeks, highlighting the sensitivity of energy costs to geopolitical conflict.

The recent surge in oil prices is partly attributed to reports suggesting Iran’s Revolutionary Guard Corps may have assisted Hamas in planning its attack on Israel. If confirmed, this revelation could lead to the Biden administration to tighten sanction enforcement against Iranian oil. Currently, the administration has been lax in enforcement, prioritizing lower global oil prices.

In light of Middle East developments, Janet Yellen, the U.S. Treasury Secretary, mentioned that the United States might take steps to enforce the $60 per barrel price limit imposed on Russian oil sales. This move is aimed at maintaining stability in oil prices while curbing the recent surge in Russian crude prices, which reached as high as $85 per barrel.

Meanwhile, Russia is planning to increase refinery throughput for the year, having experienced a temporary drop in refinery runs due to seasonal maintenance. Russia recently lifted its diesel export ban, freeing up approximately 630,000 barrels per day of potential diesel exports. However, the ban on gasoline exports and diesel sales by railway remains in place as part of efforts to stabilize domestic fuel prices.

In addition to these international factors, oil markets are closely monitoring the upcoming Consumer Price Index (CPI) and Producer Price Index (PPI) releases in the United States. Global Investment Research (GIR) forecasts a slightly below-consensus increase in September’s core CPI, indicating a year-over-year rate of 3.98%. GIR also expects a 0.30% increase in September’s headline CPI, corresponding to a year-over-year rate of 3.55%. These inflation figures will have significant implications for the oil market and broader financial markets.

As oil prices continue to react to geopolitical tensions, economic policies, and inflation data, the global energy landscape remains dynamic and uncertain, leaving investors and industry experts on alert for further developments that could impact the oil market.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.