Week in Review – October 06, 2023

Oil prices find themselves in a state of instability, grappling with a mix of macroeconomic uncertainties and concerns about global demand. Adding complexity to the situation, Russia has decided to partially lift its ban on diesel exports, with the condition that domestic sales must account for at least 50% of production.

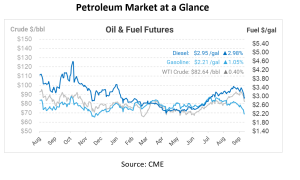

In a market where stability seems elusive, Brent futures were down 11 cents, or 0.13%, at $83.96 on Friday, while U.S. West Texas Intermediate crude futures slid by 13 cents, or 0.16%, to $82.18. Over the past week, crude prices have fallen by over 10% on a week-over-week basis, reflecting weak gasoline demand and concerns about rates–driven by the 2024 recession and technical factors.

Russia’s move to lift the diesel export ban for supplies delivered via pipeline ports constitutes a significant development in the oil market. Almost three-quarters of Russia’s 35 million tons of diesel exports in 2022 were delivered via pipelines. This shift in policy led to a momentary drop in prices, but they have since rebounded.

Brent and WTI futures were on track for significant week-on-week declines, with fears of higher interest rates slowing global growth and affecting fuel demand. Despite Saudi Arabia and Russia reiterating their voluntary supply cuts will last until the end of the year, these measures have not been sufficient to counter the downward pressure on oil prices.

Investors are closely monitoring the U.S. monthly jobs report with the hope that it shows a moderation in job growth, potentially influencing the Federal Reserve’s decision on further rate hikes. The European Central Bank (ECB) has also not ruled out interest rate hikes if inflation continues to rise.

Despite these concerns, there is some optimism regarding Chinese travel activity, with mid-autumn and National Day holiday travel seeing a significant increase. This boost in activity may help support oil prices.

In summary, oil prices remain under pressure due to various economic factors, including interest rate concerns and Russia’s partial rollback of the diesel export ban. Investors are eagerly awaiting economic data to provide further direction to the oil market. The situation remains fluid, with potential implications for both global energy markets and the broader economy.

Prices in Review

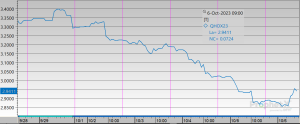

At the beginning of the week, crude oil started trading at $90.71 but experienced a decline on Tuesday, which continued throughout the week. As of this morning, crude oil began the day at $83.96, reflecting a drop of nearly $7/bbl, equivalent to a decrease of 7.441%.

At the start of the week, the price of diesel stood at $3.3281, with a minor decrease observed on Tuesday. However, the downward trend persisted throughout the week. This morning, diesel started trading at $2.9552, indicating a significant decline of $0.37 or 11.204%.

Gasoline opened on Monday at $2.4286, experiencing a slight dip on Tuesday, and then consistently declining throughout the week. This morning, the opening price was $2.2173, indicating a reduction of over 20 cents or 8.700%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.