Week in Review – September 29, 2023

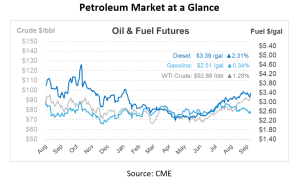

Crude futures are up and climbing this morning by more than $1/bbl. As we close out the week, they’re on track for a weekly gain of around 3%. The driving force behind this? Stockpile draws at Cushing plummeted, setting them at their lowest levels since July 2022. Since Cushing is the delivery point for WTI crude oil and the nation’s largest crude storage hubs, the location’s inventories have a significant impact on global markets. To throw numbers into the mix, prompt WTI and Brent peaked at $95.03/bbl and $97.69/bbl, respectively. However, we did see a minor slowdown – both slid over $1/bbl when prices met their key resistance levels.

This quarter might go down as a notable period for 2023, reflecting an increase of over 30%. With China’s Golden Week holidays extending to next Friday, there is optimism that crude demand will climb further as both domestic and international travel pick up.

There’s been a predictable slump in refinery utilization, considering the commencement of the fall planned maintenance period. The market, still in bullish sentiment, reacted with a hike. The real question remains: Will the current healthy demand and diminished refinery production soon lead to product draws? Only time will tell.

Two factors have been paramount in the crude supply situation: OPEC’s ongoing production cuts and shrinking U.S. crude inventory levels. Add to this the lowered SPR levels, and you have a market that’s getting edgy about crude supplies. The silver lining? If OPEC decides to up production, and the planned refinery downtime leads to a boost in crude inventories, the supply apprehensions could ease off.

To break down the numbers, U.S. crude oil inventories stand at 416.3 million barrels, roughly 4% below the five-year average. Total motor gasoline inventories rose by 1 million barrels, whereas distillate fuel inventories saw an uptick of 0.4 million barrels. Gasoline, with its seasonal nature, isn’t raising many eyebrows. However, the growing concern over crude supply is becoming palpable, especially if you’re tracking the refiner’s margin, or the ‘crack spread,’ which has collapsed over recent weeks (though still remains high compared to pre-Russia invasion levels).

The Biden administration just announced its five-year plan for offshore oil and gas leasing, and no sales are slated for 2024. This stands as the fewest auctions since the program’s inception. The unveiling follows a string of delays and fervent discussions between environmental enthusiasts and proponents of drilling. Despite the legal mandate for the Interior Department to set a five-year national oil and gas leasing schedule, a consensus has been elusive since the last schedule lapsed in June 2022.

Prices in Review

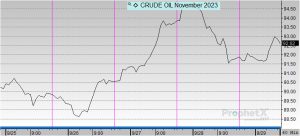

Crude opened the week at $90.55, teetered down on Tuesday, and then saw gains the rest of the week. This morning, crude opened at $91.76, a gain of $1.21 or 1.336%.

Diesel trended similarly to crude this week. It opened at $3.3366 before dipping slightly on Tuesday and picking up gains for the remainder of the week. This morning, diesel opened at $3.3451, an increase of nearly one cent or 0.25%.

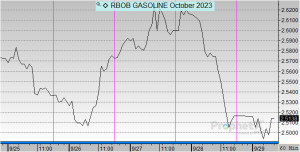

Gasoline opened the week at $2.5696, also dropping slightly on Tuesday. This morning, gasoline opened at $2.5155, a decline of around 5 cents or -2.105%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.