Oil Prices Decline as Dollar Strengthens and Central Bank Policies Weigh on Demand

This morning, oil prices experienced a decline of 50c/bbl, influenced by the strengthening of the U.S. dollar and worries that extended high interest rates from major central banks might suppress fuel demand. Both the U.S. Federal Reserve and the European Central Bank recently emphasized their dedication to combating inflation. This suggests that stringent policies might be in place for a longer duration than previously thought. An increase in interest rates can deter economic growth, leading to reduced demand for oil.

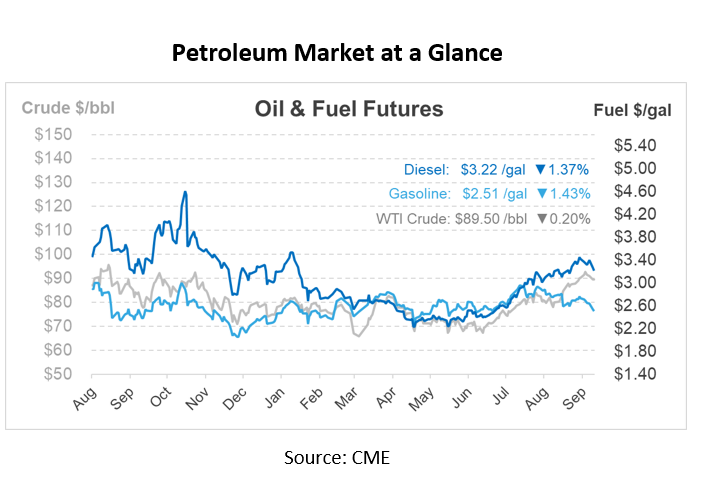

Furthermore, the U.S. dollar, a key currency in oil transactions, reached its highest peak in 10 months on Tuesday. This peak in value was propelled by elevated bond yields, drawing investors to the U.S. currency. A robust dollar can dampen oil demand, making it costlier for buyers using other currencies. On the supply front, constraints are apparent. Both Russia and Saudi Arabia have decided to prolong their production cuts till the year’s end. This restriction in supply has pushed oil prices up by approximately 30% since mid-year, reducing global GDP growth by 0.5% in the latter half of the year.

North America saw a decline in rigs for the week ending on September 22, as indicated by Baker Hughes’ rotary rig count. The U.S. lost 11 rigs, while Canada’s rig count remained unchanged, bringing the region’s total weekly decrease to 11 rigs. Currently, North America’s rig count stands at 820, with 630 from the U.S. and 190 from Canada. Over the past year, North America’s rig count has dropped by 159, with the U.S. decreasing by 134 rigs and Canada by 25. The previous count from September 15 had shown a week-on-week increase of 17 rigs for North America.

American oil production is set to achieve a significant milestone in the upcoming quarter, with analysts expecting record 13 million barrels a day. The anticipated production volume is impressive. In fact, it’s the highest globally, more than doubling in just ten years. However, this surge in production hasn’t translated into reduced fuel prices. Gasoline costs have risen by 7% since July, averaging $3.85 per gallon.

Despite the considerable efforts of US shale production, the control OPEC and its allies maintain over the market remains evident. Earlier this year, global oil demand reached a record-breaking 103 million barrels daily. The supply from non-OPEC nations has struggled, reflecting years of inadequate investment. Contributing to the surge in crude prices, Saudi Arabia’s voluntary production reductions until year-end have resulted in a 10% spike within a month, pushing prices above $90 a barrel.

Many might expect this situation to pave the way for shale to aggressively boost production, challenge OPEC’s dominance, and consequently decrease oil prices. However, that’s not a probable scenario. Although shale production has risen 700,000 barrels per day this year, further gains will be tough to sustain – and oil companies are being more cautious about investing in new production.

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, gasoline, inventory, prices, production, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.