Crude Hits 10-Month High While North America Preps for Canadian Pipeline Expansion

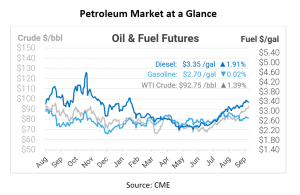

Prompt crude futures are up today, witnessing a spike of approximately 90c/bbl for WTI and around 40c/bbl for Brent, reaching their 10-month high. These increases are a continuation of a three-week streak and are anticipated to continue until the expiration of the October 2023 WTI Contract tomorrow. One significant reason for the upward momentum is the supply concerns raised by the decline of approximately 2.8 mmbbls in the Cushing stocks over the past week.

Equity futures have risen, and the dollar shows a downward tendency in today’s trades, particularly with the FOMC meeting scheduled for tomorrow. Additionally, concerns of a potential supply deficit, magnified by reduced U.S. shale output and prolonged production slashes by major players like Saudi Arabia and Russia, have driven oil prices higher.

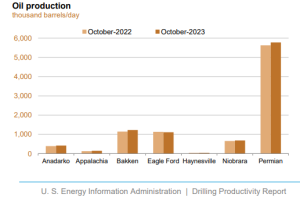

The EIA, in its September Drilling Productivity Report released yesterday, foresees a drop in oil production by 40 kbpd, reaching 9,393 kbpd in October. The projections show that production in both Permian and Eagle Ford might plummet to their lowest since April 2023 and December 2022, respectively. The decline of 39 drilled but uncompleted wells (DUCs) in August, especially the 14-well drop in the Bakken region, further emphasizes this.

The diesel market hasn’t been left untouched. Diesel experienced a sharp decline on Monday, with October futures dropping by 9.51cts to settle at $3.2883/gal. Speculations indicate minimal inventory builds in the upcoming months, at least until November, suggesting a pause before speculative buyers make their next big move.

The North American market has its eye on the expansion of Canada’s Trans Mountain oil pipeline (TMX). With plans to nearly triple the crude flow from Alberta to the Pacific Coast of Canada by early next year, North America is bracing for a considerable shift in oil supply.

This expansion could elevate prices by as much as $2/bbl for U.S. Midwest oil refineries situated along Canada’s main oil-export route. A proposed last-minute route alteration might push the project’s commencement by up to nine months.

When TMX becomes operational, it will empower Canada to transport an additional 590,000 bpd to Pacific ports. These will be directed to refineries on the U.S. West Coast and in Asia, where the demand for heavy sour crude is anticipated to rise long-term.

This article is part of Daily Market News & Insights

Tagged: 10-Month High, Canadian Pipeline Expansion, crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.