Week in Review – September 15, 2023

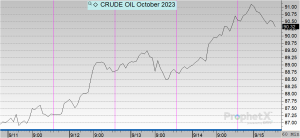

Crude oil has touched its highest levels for the year this week, reaching a pinnacle of $91.10 with further gains possible today. The rally was spurred not just by crude dynamics but also by significant macroeconomic shifts. The Chinese central bank, in a move to rev up its economy, cut the reserve requirement ratio by 25bps. Meanwhile, the ECB adjusted its main refinancing rates by 25bps to 4.50%, signaling what could be the culmination of ECB rate hikes.

Both Saudi Arabia and Russia’s decision to cut their output is expected to lead to a supply deficit that will last through the end of 2023. Further backing this perspective, OPEC+ and the IEA forecast crude deficits of 3 mmbpd and 1.2 mmbpd respectively, for the last quarter of 2023. This is coupled with increasing demand for crude as oil processing hits a staggering 15.3 mmbpd in China, primarily influenced by Chinese refiners ramping up their operations and expanding fuel exports. To put this into perspective, the world consumes around 100 mmbpd of crude oil and refines about 80-90 mmbpd.

Despite larger-than-anticipated inventory builds noted in this week’s Department of Energy (DOE) report, the market mood remains bullish. One pivotal factor not highlighted in the DOE report is open interest, a metric that sheds light on the market’s propensity to buy (long) or sell (short). With net longs in crude (WTI) increasing to 3% of open interest in the last month, bullishness is at levels we haven’t witnessed since the week of Russia’s invasion of Ukraine in February 2022. One of the dominant reasons for this bullish behavior centers on concerns over global crude supply levels, primarily due to sustained production cuts by OPEC+.

While diesel supply in the U.S. is seeing some improvement, it’s still not up to par, especially as we approach the colder seasons. The East Coast continues to face supply challenges expected to last through winter. Conversely, the mid-west is oversupplied, leading to a basis spread of over 40 cents between Chicago and New York Harbor diesel gallon prices.

The recent spike in fuel prices has reignited inflationary concerns in the US. Gas prices have been at the forefront of this inflation, contributing to over half of the recent surge, as per the Department of Labor. While the current demand remains consistent, the blend of escalating energy prices and potential interest rate hikes might hamper demand in the future.

Prices in Review

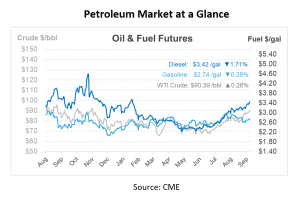

Crude opened on Monday at $87.40 before reaching its highest point in the year. This morning, crude opened at $90.67, an increase of $3.27 or 3.74%.

Diesel opened the week at $3.2994 and saw steady gains each day. This morning, diesel opened at $3.4749, an increase of 17 cents or 5.32%.

Gasoline opened the week at $2.6545 and also experienced a week of increases. This morning, gasoline opened at $2.75, an increase of about 10 cents or 3.635%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.