Global Oil Dynamics are Causing Crude Futures to Heat Up Ahead of the Fall Season

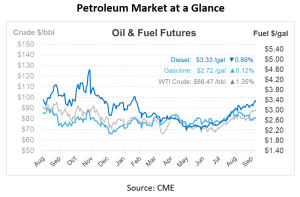

Crude futures are off to another week of increases, currently trading up by 70c/bbl. This momentum follows suit with the recent positive trend observed in both WTI and Brent crude futures. As of yesterday, these futures persisted in their upward trajectory, echoing the pattern from last week and keeping crude at its year-to-date high levels.

Diesel futures have also climbed to their highest point since January. This rise is attributable to the tighter global market conditions, which were primarily influenced by factors like the halt of Russian diesel exports, a crunch in global stocks, and a reduction in diesel-rich crude from OPEC+ producers.

As we transition into the fall season, refiners are gearing up for their scheduled maintenance, which could hamper efforts to replenish inventories. Add to this mix the increasing demand spurred by farming, trucking, and the impending heating season, and we might witness an interesting supply-demand dynamic.

In some positive news from Libya, despite the havoc caused by an extreme storm earlier this week, their oil ports have emerged unscathed. Currently, oil output from the nation is consistent, hovering around 1.2 mmbbl/d. On the North American front, close to 500,000 b/d refinery capacity on the Eastern Seaboard is projected to go offline for an extended maintenance phase beginning next weekend, restricting significant storage build-ups.

Diplomatic strides between the US and Iran continue to gain ground. The US sanctioned the release of $6 billion in oil proceeds to Iran. Furthermore, the easing of restrictions on oil sales from Tehran has begun, as confirmed by US officials. A considerable portion of this Iranian supply finds its market in China.

The Strategic Petroleum Reserve (SPR) welcomed an injection of around 300,000 bbls last week. This was in line with the Biden administration’s endeavors to boost inventories. As of September 8th, the total SPR inventory stood at 350.6 million bbls, marking a subtle rise from its previous 350.3 million bbls. Interestingly, this recent build was purely of sour oil, with the sweet oil inventory remaining static at 143.5 million bbls. Additionally, out of the 6.3 million bbls acquired from private entities for August-September delivery, the DOE has already received 3.9 million bbls.

Mirroring the momentum of the benchmark U.S. diesel futures, which saw a 7.6% increase since last month, the prices of distillates (diesel and heating oil) have also catapulted. This price uptick has incentivized a handful of imports from regions beyond the immediate vicinity. Notably, these imports are coming from diverse sources as distant as Colombia and Nigeria. The sanctions imposed on Russian crude exports have triggered disruptions in the traditionally established supply trajectories. European refiners, who have been significantly reliant on these supplies for their fuel production, are especially feeling the heat.

The Northeastern US stands tall as the world’s premier heating oil market. It shoulders over 80% of the nation’s total heating oil consumption. Given this reliance, the approaching winter season could further constrict supplies. If the winter turns out to be colder than anticipated, American households might have to brace themselves for heftier heating bills.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.