Week in Review – August 25, 2023

This morning, crude futures are up $1/bbl, indicating some cautious optimism amongst traders who are awaiting comments of Fed Chair Powell during the Jackson Hole Symposium on the future trajectory of interest rates. With the US dollar soaring to a 10-week high just before the symposium, the financial sector is buzzing, and it’s bound to ripple through our industry.

WTI and Brent have both increased this week, rising about $2/bbl from their monthly lows. Throughout the week, the crude market faced a pullback from its monthly gains, primarily driven by ongoing worries about the global economic landscape. The stability of China’s economy and its housing sector remains under scrutiny. Recent data indicates shrinking activity and manufacturing outputs across the US, Europe, and Asia. The EIA announcement of US crude stocks reaching their annual low has caused crude prices to rise. On the other hand, subsequent reports of potential US-Venezuela discussions on easing sanctions have led to price decreases.

International relations concerning oil saw the spotlight this week. Discussions about reinstating the Iran nuclear deal took center stage. Especially noteworthy was the news that US officials seem to be softening their stance on Iranian oil sales sanctions. Simultaneously, there’s chatter about Venezuela’s sanctions possibly easing. Both can play pivotal roles in supply adjustments.

An important dialogue unfolded between Turkey’s foreign and energy representatives and Iraq’s Kurdistan regional head. While the essence revolved around oil exports, the specifics remained veiled. The exact nature and outcome of discussions on Iraq’s northern oil exports, especially concerning the Ceyhan port in Turkey, stay under wraps. Russia’s petroleum sector has had its fair share of shifts. Their refined fuel exports seem to be dwindling, marking a 15-month low, attributed mainly to robust domestic demand and G7 price cap breaches. With Russia opting to reduce its crude production due to sanctions, their every move is being watched closely.

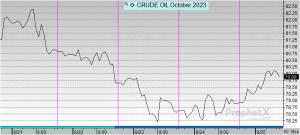

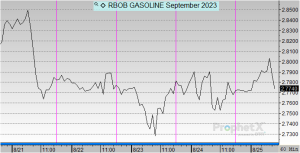

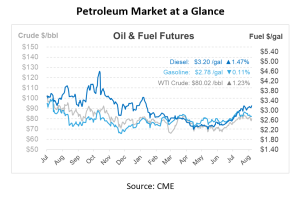

Prices in Review

Crude opened the week at $81.43 before experiencing steady declines the rest of the week. This morning, crude opened at $78.88, a $2.55 or -3.13% decrease.

Diesel opened the week at $3.1713 and saw some up-and-down swings throughout the course of the week. This morning, diesel opened at $3.1533, a dip of nearly two cents or -0.568%. A rally this morning shows potential to shift diesel markets from a weekly loss to a weekly gain.

Gasoline opened the week at $2.8161 and experienced declines for the next two days before increasing slightly on Thursday. This morning, gasoline opened at $2.7729, a decrease of about four cents or -1.534%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.