Week in Review – August 18, 2023

After a seven-week rally in oil prices, a notable downturn seems imminent as we approach this week’s close. Those observing global energy markets have fixed their eyes on China’s economic setbacks, a potential factor behind this week’s dip in oil prices.

The past seven weeks, fueled by OPEC+’s strategic supply cuts, witnessed both the Brent and WTI benchmarks record their longest gain streak for the year. However, the wheels seem to be turning the other way this week, with prompt crude futures trading down by 50c/bbl. To give perspective, crude went up by $1.7/bbl yesterday but then settled to a 70c/bbl and $1/bbl increase for Brent and WTI, respectively. With the ongoing decline, the potential weekly drop for both contracts could exceed $3/bbl – marking the first such event since June. Meanwhile, both stock futures and the dollar experienced a drop, as the FOMC July meeting minutes hinted at inflation risks due to yesterday’s surge in Treasury yields, reaching a decade high.

Brazil recorded an all-time high in Russian crude imports this month with a total of 235k bbl/d, showcasing Russia’s intent to diversify its crude exports beyond Asia. In a parallel development, China tapped into their historic inventories accumulated earlier, estimating a procurement of 750k to 1mm bbl/d of crude for storage during the first half of 2023. Further solidifying their position, China also tripled their diesel exports in July to 219k bbl/d, riding on the price rally wave.

China made an unusual draw from its crude oil storage in July, marking the first in almost three years. The U.S. wasn’t far behind, with its commercial crude oil inventory (excluding SPR) going down by 6 million barrels in just a week (from August 4 to August 11), as reported by the U.S. Energy Information Administration (EIA). As of August 11, crude oil stocks, excluding SPR, amounted to 439.7 million barrels.

On the refining front, inputs averaged 16.7 million bpd during the week ending on August 11, up by 166,000 bpd from the previous week. Interestingly, refineries were operating at 94.7% of their capacity. Gasoline production saw a decline averaging 9.6 million bpd.

Prices in Review

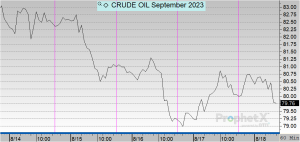

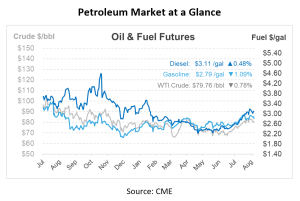

Crude prices opened on Monday at $83.09 and saw steady decreases throughout the week. This morning, crude opened at $80.04, a drop of $3.05 or -3.67%.

Diesel opened the week at $3.1152 and also saw steady declines over the next few days. This morning, diesel opened at $3.0908, a decrease of about two cents or -0.783%.

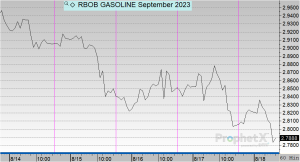

Gasoline opened on Monday at $2.949 before experiencing declines the rest of the week. This morning, gasoline opened at $2.8063, a drop of 14 cents or -4.84%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.