Week in Review – August 11, 2023

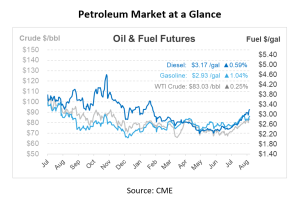

Crude prices rallied this week and are up roughly 40c/bbl this morning, reversing some of yesterday’s losses. Prompt WTI prices touched their highest for the year, settling at $84.89/bbl. Brent also peaked this week, touching $88.10/bbl, a rate unseen since April. But what spurred this sudden rally?

Several factors were at play, driving these prices up. The overarching supply apprehensions for crude, coupled with its by-products, played a pivotal role. Geopolitical tensions added to the upward pressure as Saudi Arabia announced it would be extending its production cuts for another month. Looming uncertainties around Ukraine’s potential actions against Russia have ignited some skepticism. Markets have also been wary of retaliation efforts after a Russian oil tanker was targeted by a Ukrainian drone in the Black Sea earlier this week.

Two major entities, the International Energy Agency (IEA) and OPEC+, released their monthly reports this week. The IEA reaffirmed its 2023 demand growth projection at 2.2 mb/d, culminating in a total demand of 102.2 mb/d. China is expected to fuel over 70% of this growth. The IEA also highlights potential challenges for 2024’s oil demand, including economic downturns, stricter efficiency standards, and the rise of electric vehicles. This has led them to bump their 2024 demand growth projection down by 100 kb/d, settling at one mb/d. On the supply front, the IEA adjusted their 2023 growth prediction down by 100k bpd to 1.5 mb/d while raising the 2024 forecast to 1.3 mb/d, with an emphasis on non-OPEC+ sources as the primary contributors to this growth.

OPEC+ unveiled its August monthly report yesterday and retained its global crude demand estimate for 2023 at 2.4 mb/d. As for supply predictions, the 2023 non-OPEC+ output is expected to increase by 0.1 mb/d from the previous month’s forecast, reaching 1.5 mb/d. This adjustment is influenced by production trends in countries like the US, Brazil, and Norway.

Iranian crude may soon be available to global markets pending a political agreement after four US citizens were transitioned from incarceration in Iran. This move marks the initial phase of a potential agreement between the two nations. While the details of the agreement have been kept under wraps to ensure the negotiations remain undisturbed, US Secretary of State Antony Blinken has acknowledged that the development is a step in the right direction.

Prices in Review

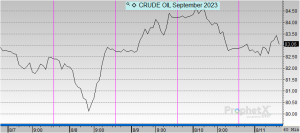

Crude opened the week at $82.82 and traded within 60c/bbl all week. This morning, crude opened at $82.83, an increase of one cent or 0.01207%.

Diesel opened the week at $3.0699 and saw up and down trends throughout the week. Diesel peaked yesterday at $3.2107. This morning, diesel opened at $3.1502, an increase of 8 cents or 2.616%.

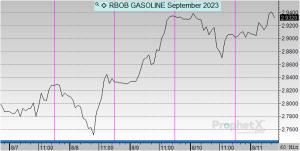

On Monday, Gasoline opened at $2.7887 before experiencing steady gains throughout the week. Gasoline opened this morning at $2.9037, an increase of 11 cents or 4.12%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.