Fueling the Fire: Behind the Recent Spike in Oil and Gas Prices

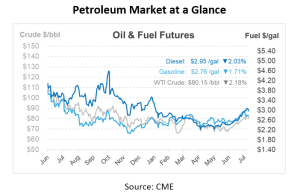

Our wallets are feeling the heat this summer. As of last week’s EIA report, the national average price for a gallon of regular unleaded gasoline soared to $3.821, with diesel clocking in at $4.131. These figures are a steep climb from last month, and although they fall short of the prices we grimaced at in 2022, there’s no denying the sharp uptick. So, what’s behind this price escalation?

The biggest factor has been trends in global crude oil markets. Western sanctions on Russian oil have been largely circumvented by sales to other countries, but the re-routing has had the effect of removing some “slack” from markets. Moreover, OPEC’s production cuts – along with Saudi Arabia’s extra voluntary cuts – have further reduced global supply options. Five years ago, that gap would have led US shale producers to flood the market – post-COVID, however, producers are being more cautious about bringing on new drilling. Market analysts believe that these trends could further propel crude oil futures toward the $100 per barrel landmark.

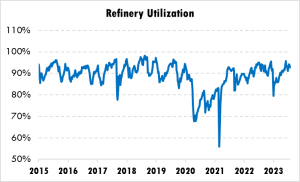

This summer’s unrelenting heatwave has amplified the situation, squeezing the prices at the pump even further. The high temperatures interfere with the efficient operation of refineries, especially those along the Gulf Coast, which houses much of the US’s refining capacity. Although refineries might like to run at higher rates, the heat presents the risk of equipment damage, hindering output. Still, utilization has returned to pre-COVID levels, minus some refinery closures that present long-term challenges for fuel supply.

This isn’t a situation central banks, including the Federal Reserve, can overlook either. As they grapple with reining in inflation to their target levels, the escalating oil prices only add to their headaches. Notably, energy forms a significant component in headline inflation and is a crucial input for many goods and services. This means that price escalations can bleed into core inflation. Motor fuel, electricity, and piped gas together form nearly 7% of the U.S. consumer-price index.

It’s not just the heat and oil price fluctuations that are to blame, though. Global supply and demand dynamics both play an equally important role. On the demand side, as China emerges from one of the world’s most stringent COVID restrictions, its robust recovery is slowed by logistical roadblocks. But as the nation’s 1.4 billion residents slowly get back into the groove of everyday life, fuel demand is growing, pushing gas prices further upwards.

So, will the prices continue their northbound journey? While we all hope for some relief from the scorching heat and increased prices as we approach fall, hurricane season is upon us. When hurricanes hit, it could cause refineries to shut down operations for days to weeks at a time, depending on the severity. If that happens, our oil and gas prices could continue to face the heat.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.