Week in Review – July 28, 2023

This morning, prompt oil futures are down 80c/bbl; however, they remained on course for a fifth consecutive weekly gain, with prices rising by over 3% compared to the previous week. The surge in crude prices this week can be attributed to a series of bullish factors.

Policymakers in China have pledged to take significant measures to stimulate economic recovery following the second quarter’s sluggish growth. These stimulus measures are expected to boost market confidence and contribute to the upward trajectory of oil prices. Concurrently, concerns persisted regarding the global oil supply due to declining inventory in the United States and voluntary output cuts of 1 million barrels per day by major producer Saudi Arabia.

Another influential factor was the Federal Reserve’s announcement of a potential tapering in rate hikes, with future hikes contingent on the economic data from the United States. This development further bolstered optimism in the market, propelling crude prices to their highest levels since April.

Prompt WTI and Brent oil remained within $1 per barrel of this week’s three-month highs, reaching $80.60/bbl and $84.50/bbl, respectively. Additionally, US gasoline futures climbed to a nine-month peak as a result of unplanned refinery outages and increased summer driving demand. Despite these gains, the prompt contract slightly removed some of its previous gains during the week.

This week, the backwardation in the prompt WTI and Brent calendar spreads steepened, indicating expectations of a tighter near-term outlook for the oil market. The WTI spread for Sep23-Oct23 settled at $0.46/bbl yesterday, the widest level seen since April. Higher spreads mean that traders are willing to pay a premium for sooner delivery – incentivizing suppliers to draw down inventories since they’ll get a higher price by selling today vs waiting until next month.

This week’s developments in the petroleum industry reflected a mix of positive sentiments and supply concerns, driven by global economic factors and geopolitical events. Market participants must closely monitor these developments as they navigate the ever-changing landscape of the oil market and make informed decisions for their purchasing and operations.

Prices in Review

Crude opened on Monday at $77.01 before hitting a two-day steady incline. This morning, crude opened at $79.84, an overall increase of $2.83 or 3.675%.

Diesel opened on Monday at $2.7458 and saw steady inclines all week. This morning, diesel opened at $2.9006, an increase of 15 cents or 5.64%.

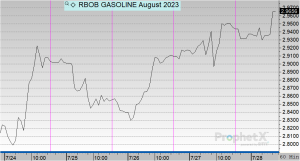

Gasoline opened on Monday at $2.7963 and also saw steady increases throughout the week. This morning, gasoline opened up at $2.9460, an increase of nearly 15 cents or 5.35%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.