Week in Review – July 14, 2023

Several key reports were released this week providing significant insights for the future of oil and petroleum markets. The Consumer Price Index (CPI) report from Wednesday morning marked an increase of 3%, aligning neatly with expectations and, crucially, down from last month’s 4%. This increase is the smallest we’ve seen since March 2021. As a result, the US dollar experienced an immediate decrease in trade value, sparking a concurrent rise in commodity values. As many of you will remember, there is usually an inverse correlation between the dollar and commodity values.

It’s also worth noting the figures for Core CPI, which exclude the volatile sectors of food and energy. The decrease here was more modest, moving from 5.3% to 4.8%. However, the 28-month low in Core CPI data provides a glimmer of hope for those worried about inflationary pressures.

Turning our attention to the Department of Energy report that was also released on Wednesday, it was anticipated that refinery utilization would see an uptick. The data delivered on this expectation, showcasing an increase of 2.6% nationwide. This included a notable jump of 3.8% in Padd 2. Directly linked to this utilization spike is the current low trading values of Chicago ULSD basis, due to an oversupply in the Chicago origin areas. What is the result? A striking 40 cent spread between places like Indianapolis and Nashville (with Nashville sourcing from the Gulf Coast). It’s certain that we will start seeing these variations in OPIS pricing, but keep in mind these differences might not immediately appear in retail market prices due to street-level delays.

In terms of diesel, the large inventory build is beginning to alleviate concerns surrounding supply. With that said, consistent weekly builds over the next few weeks will provide much-needed capacity heading into the upcoming fall season. To give some perspective, diesel inventories remain 14% below the five-year average, albeit including the significant builds of 2020.

Andy Milton, SVP of Supply at Mansfield Energy said in a response to this week’s DOE report, “Gasoline remains a short-term concern, particularly as we approach the end of the summer and the RVP season. The futures backwardation suggests a potential ‘Just-in-Time’ gasoline supply situation in some markets.”

Prices in Review

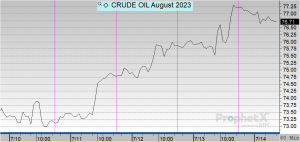

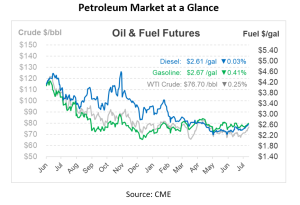

Crude is on track for a weekly gain of about 4%. Crude opened on Monday at $73.86, and steadily increased each day of the week. This morning, crude opened at $77.16, an increase of over $3 or 4.47%.

Diesel opened on Monday at $2.5623, and saw marginal gains throughout the week. This morning, diesel opened at $2.6181, an increase of 5 cents or 2.178%.

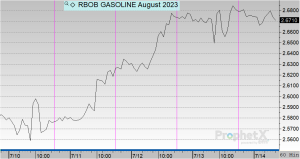

Gasoline also saw marginal gains throughout the week, opening at $2.59 on Monday morning. Today, gasoline opened at $2.6789, an increase of nearly 9 cents or 3.43%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.