Week in Review – July 7, 2023

Oil prices moved higher on Friday, keeping up the momentum for the second week in a row. The unexpected plunge in U.S. oil inventories has taken center stage, overshadowing concerns over the potential surge in U.S. interest rates. The market is apprehensive as speculation intensifies regarding the U.S. Federal Reserve’s decision on interest rates during its meeting on July 25-26, which could potentially impact the industry’s growth and oil demand.

Despite equity futures and the dollar facing a downturn, which persisted for three days, crude managed to carve its own path. Most of Thursday saw crude lower trading but reversed the losses when the Energy Information Administration (EIA) reported a 1.46 million barrel withdrawal from storage. Though this figure was below the expected draw, an equivalent amount drawn from the Strategic Petroleum Reserve bumped the total to nearly double. In turn, weekly gasoline implied demand leaped to 9.6 mmbbl/day – a peak not achieved since December 2021.

Both WTI and Brent crude increased this morning, with WTI surging by $1.50/bbl and Brent following suit with a rise of approximately $2/bbl. Crude prices are still lower compared to the aftermath of OPEC’s initial production cuts back in April, and have been sailing through a rather narrow less-than-$10/bbl range since mid-May.

On Thursday, the Energy Information Administration (EIA) reported a crude draw of 1.5 million barrels for the week ending June 30th, outpacing Reuters’ expectation of 1.0 mmbbls, while Cushing recorded a 0.4 mmbbls draw. The EIA reported gasoline inventories dipping by 2.5 mmbbls and distillate inventories by 1.0 mmbbls, surpassing Reuters’ forecast of a 1.4 mmbbls gasoline draw and a 0.3 mmbbls distillate build. Crude inventories currently stand 1% below the five-year average for this period, while gasoline and distillate inventories are trailing by 7% and 16% respectively.

Standard Chartered analysts noted in a recent market report that Brent oil prices, which have been hovering in the $74-76/bbl range, could have surged higher if not for an unusually high degree of speculative shorting. Data shows speculative shorts in Brent and WTI contracts rose by 45.029 million barrels to a 33-month high. The report highlighted a divergence between speculative positioning in oil and the fundamental outlook; while balances show significant tightening, speculative positions indicate increased bearishness. Analysts believe the current scale of speculative shorting is excessive and anticipate that closing these short positions will be a catalyst for pushing Brent prices above the $74-76 range.

Brent prices have been relatively stable, with 21 consecutive trading days within the $74-76/bbl range. According to Standard Chartered, Brent prices are projected to average $91 per barrel in 2023, $98 in 2024, and $109 in 2025. Meanwhile, the U.S. Energy Information Administration (EIA) projected slightly more conservative figures, estimating Brent prices to average around $79.54/bbl in 2023 and $83.51 in 2024. Several agencies, including Enverus Intelligence Research and BofA Global Research, foresee factors such as global oil demand and OPEC intervention driving Brent prices toward or above $80/bbl.

Prices in Review

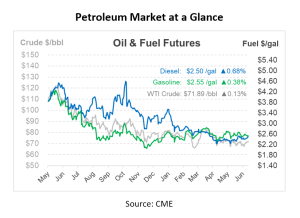

Crude opened the week at $70.45 and increased throughout the week. This morning, crude opened at $71.89, and increase of $1.44 or 2.044%.

Diesel opened on Monday at $2.4366 before trading lower on Wednesday following the Tuesday holiday. This morning, diesel opened at $2.4864, an increase of nearly 5 cents or 2.044%.

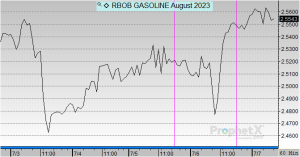

Gasoline opened at $2.5364 on Monday and also tapered off a bit following the Tuesday holiday. This morning, gasoline is back up and opened at $2.5534, an increase of almost 2 cents or 0.67%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.