What is it – Upstream Petroleum Industry

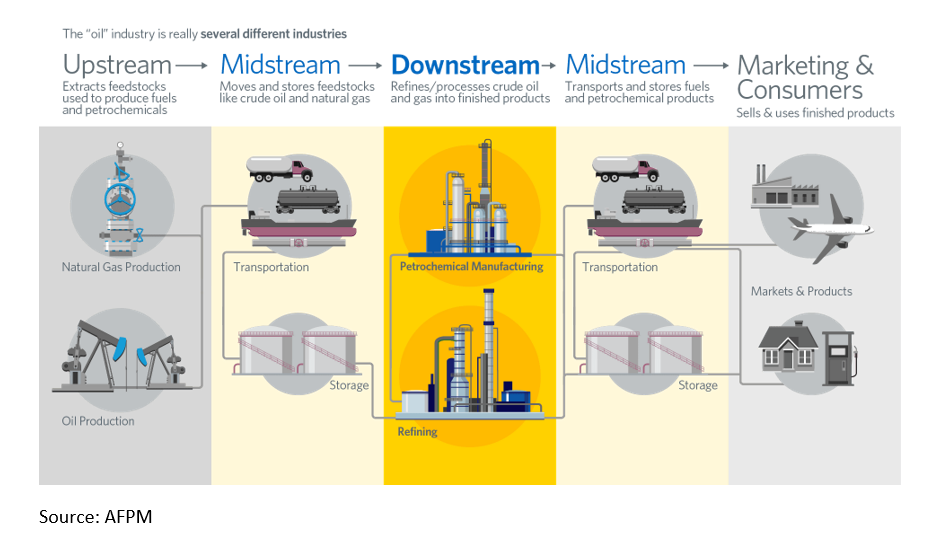

The expressions “upstream” and “downstream” in oil and gas production denote a company’s position within the supply chain. Typically, companies within this industry are categorized into three segments: upstream, midstream, and downstream. In the petroleum industry, it’s important to understand the segments that make up the entire industry. Today’s What is it Wednesday is going to focus on the “upstream” portion of the industry, delineating the steps involved.

What is Upstream?

Upstream oil and gas production is carried out by companies engaged in the identification, extraction, and production of raw materials. The upstream petroleum sector involves the exploration and production of crude oil and natural gas. In simpler terms, it’s all about finding reserves and extracting them.

The upstream sector employs a diverse range of professionals, including geologists, geophysicists, service rig operators, engineers, scientists, and contractors specializing in seismic and drilling activities. These experts play a crucial role in locating and estimating reserves before the commencement of actual drilling.

Large companies such as China National Offshore Oil Corporation and Schlumberger predominantly focus on upstream services. Additionally, some of the most prominent upstream petroleum operators are the major diversified oil and gas corporations, such as ExxonMobil and Shell.

What are the steps involved in the upstream process?

The upstream petroleum process in the oil and gas industry commences with exploration, where geological surveys and seismic studies pinpoint potential hydrocarbon deposits. Following the discovery, appraisal wells are drilled to evaluate the deposit’s size and commercial viability through data analysis on pressure, flow rates, and reserves. If deemed feasible, the development phase kicks in, entailing the drafting of plans for wells and infrastructure construction, such as pipelines and processing facilities, along with conducting environmental assessments and acquiring permits.

Subsequently, the production phase sees oil or gas extraction through methods like pumping and water or gas injection. Ultimately, when the reservoir’s resources are either exhausted or no longer economically sustainable, the decommissioning phase takes place. This involves dismantling the production facilities and rehabilitating the site to mitigate environmental impacts.

Exploration

Oil and gas exploration involves sophisticated techniques to identify potential drilling sites for resource extraction. Initially dependent on surface indicators like natural oil seeps, the evolution of science and technology has rendered the exploration process more efficient. Geological surveys now employ methods ranging from subsoil testing in onshore exploration to seismic imaging for offshore ventures. Energy companies vie for mineral rights, which governments grant through concession agreements, where producers own the discovered resources, or production-sharing agreements that allow government ownership and participation. Given the high-risk nature, exploration is costly and mainly financed by corporate funds. Unsuccessful ventures involving seismic studies and dry well drilling can cost between $5 million to $20 million per site or even more. Conversely, successful explorations recoup costs and are relatively economical compared to other production expenses.

Assessing proven reserves is vital, as it estimates the volume of economically extractable oil and gas using current technology at a particular time. These assessments are regularly updated over a lease’s lifetime. Technological advancements have a significant impact on these estimates. For instance, innovations in hydraulic fracturing and horizontal drilling led the U.S. Geological Survey to escalate its proven reserves estimate for the Marcellus Shale by 40 times. Market prices and existing infrastructure also play a critical role in influencing reserves estimates.

Production

The oil and gas production of the upstream sector stands as one of the most capital-demanding industries, necessitating not only pricey equipment but also a workforce with specialized skills. Upon determining the location of oil or gas, companies initiate the planning phase for drilling. It’s common practice for oil and gas companies to collaborate with drilling specialists and cover the costs associated with labor and daily rig rates. Factors such as the depth of drilling, the hardness of rocks, weather conditions, and the site’s remoteness can significantly influence the duration of drilling. Adopting smart technologies for data monitoring enhances drilling efficiency and well performance by offering real-time insights and trends. While all drilling rigs share fundamental components, the drilling techniques employed are contingent on the type of hydrocarbon and the geological characteristics of the site.

Why is upstream considered the riskiest sector of the industry?

The upstream sector is often regarded as the most intricate among all the segments. It’s characterized by substantial capital requirements, elevated risks, and rigorous regulations. The investments in the upstream sector are fraught with uncertainties, primarily because the outcomes of each drilled well are unpredictable. Concerns regarding safety and environmental implications compound risks.

In the international arena beyond the United States, host countries’ political landscapes and regulatory frameworks significantly influence the upstream industry. This includes political volatility such as wars, civil strife, and international conflicts; legal frameworks and regulations encompassing environmental and social stipulations; price ceilings and taxation structures; risks of expropriation or coerced divestment of assets; and adherence to contractual agreements.

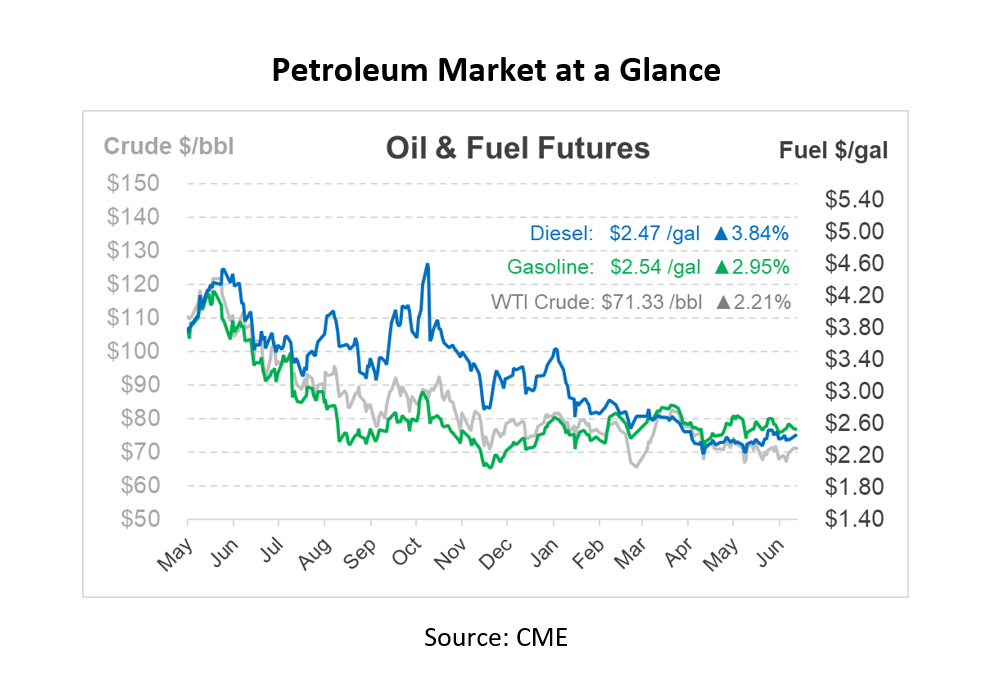

This sector is susceptible to global dynamics such as supply and demand, economic fluctuations, and crude oil production quotas. Seasonal weather variations and disruptions caused by severe weather events, particularly in vulnerable locations, also have the potential to impact production.

Technology is a linchpin across the upstream industry, contributing to its capital-intensive nature. Through technology, efficiencies are sought, and new frontiers in exploration and production are explored.

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, demand, gasoline, Inventories, oil prices, production, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.